Breaking Brick and Marring Mortar

Written by Santosh Sankar, 2017-06-18

The landscape at our local shopping malls are about to look more like gold rush era ghost towns vs centers of commerce. eCommerce has primed consumers to shop from the comfort of their homes, expect fast fulfillment of goods, and guaranteed competitive prices. The effect has roiled traditional brick and mortar as we know it. In 2017 alone, there are expected to be 3,000 store closures as eCommerce momentum continues to build. Some noteworthy closures include:

- JC Penny: 140 stores, mostly in rural areas

- Macy’s: 68 stores, including one in downtown Minneapolis opened in 1902

- Sears and Kmart: 42 and 108 stores, respectively

- The Limited: 250 stores (filed for bankruptcy)

- Chico’s, White House Black Market, and Soma: 120 stores

- Children’s Place: 200 stores

- Wet Seal: 171 stores (remainder of physical footprint and filed for bankruptcy)

- Sports Authority: 140 stores

- Wal-Mart: 269 stores, worldwide

- Office Depot: 50 stores

- Aeropostale: 154 stores in US and Canada (effectively leaving Canada)

The Long-Term Trend

Shopping malls are on the long-term path to become mix use facilities for logistics and experience-driven show rooming. Space is valuable, and the way one extracts economic value from vacancy is evolving. There’s one of two options here as we see more square footage empty: 1) Sell the asset to a party that can better utilize it or 2) Embark on a multi-year shift of business models (either organically or inorganically). Underpinning both strategies is a more updated way of utilizing space — increasing inventory usage while reducing show rooming.

This is a boon for eCommerce providers and the brick/mortars that are trying to evolve with the times.

Inventory Expansion

According to ICSC, about 20% of gross leasable space in a shopping mall is used for inventory (with the remaining space used for show rooming). As pressures mount due to continued declines in brick/mortar sales, this percentage should shift.

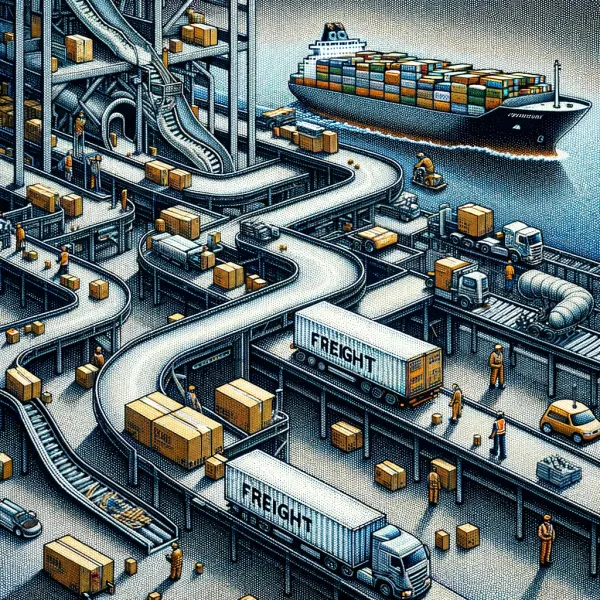

It makes more sense to have more space allocated to holding inventory, given that malls are strategically located near large populations of consumers. This is inherent value in those empty Kmarts or soon-to-be-shuttered Macy’s stores since part of the last mile equation is the ability to store, stage, and distribute goods away from the traditional hub-spoke model. I sometimes use the term micro-warehouses to describe those that are smaller, hold less inventory but turn it more quickly (based on data), and are closer to the buying population.

Experience-Driven Show Rooming

So if more square footage is used for inventory, what about show rooming? Given the nature of shopping malls, one could fulfill limited in-store shopping as well — “omnichannel lite.” Some good examples of eCommerce retailers using showrooms include Warby Parker (where you can try on glasses, purchase, return and even get your eyes examined at certain locations), Casper (where you can take a nap on a Casper mattress), and Allbirds (just opened its first store this week, where you can try on and buy their products).

This showroom model allows customers the opportunity to try out the product first-hand, potentially purchase or make easy returns, and more importantly, when done right, the experience at the showroom builds loyal customers who can then shop online with ease and confidence for future purposes.

A successful showroom should:

- Provide hyper-relevant experiences with data

- Utilize people to complement the experience

- Continuously iterate upon the experience

Capturing The Opportunity

You must gain logistics chops. It’s not easy to operate a responsive, data-driven, omni-channel node — Especially when there are many of them (because they are micro warehouses). Retailer or mall operators: the shift requires a massive increase in logistics chops as it relates to inventory management and distribution center operations.

The types of objectives one would have to solve for include: inventory visibility, DC automation, omni-channel inventory management, last-mile handoff operations, et al. It wouldn’t surprise me if we see mall operators acquire or pay big dollars to gain these skills. Upstart online retailers are quickly realizing their teams need logistics competencies sooner vs later.

Technology is a must. Like other large businesses, brick/mortar and mall operators have been slow to embrace technology. It’s not enough just to have logistics brains, but the ability to apply technology to solve the problem at scale and in an economic manner. The tolerance for failure is a must as well. Not every technology will work or be the solution — particularly in showrooming. If we point to Amazon as the ideal — everyone who is not Amazon striving to be — remember that they value experimentation, iteration, and failure.

It’s time for a business model shift. Mall operators and land lords might have to give up the annuity streams from a more service-based model. Upside should be earned in a manner that reflects the multi-use nature of space. Currently, an industry norm in shopping malls is for a sales-based lease arrangement that only accounts for in-store sales and not eCommerce. This means that malls are not incentivized to iterate and evolve. Unfortunately, the party that might have the most to lose here are the asset owners who need to quickly drive upsell beyond just space and build-out.

It will be interesting to see how a rise in vacancies are dealt with. I believe that this rings in an era where eCommerce providers improve their supply chain and open up right-sized physical outlets. Landlords themselves will likely see a shift in business models and operations — the logistics providers of tomorrow might be pivoted, tech-driven mall operators.

Notes

One argument against the mix shift of space is that brick/mortar is still king with 90%+ of sales. That’s true, but when we think about the future, it’s hard to discount sustained momentum and the facts supporting it —

- eCommerce sales have more than doubled their share of total retail revenues in the last decade

- Q4 2016 sales were +14.3% y/y (q/q growth was flat)

- Buying behaviors continue to uphold online vs in-store interactions

- Varying technologies and operations are helping with lack of show rooming online (think VR, try-at-home)