The Erosion of Trust in Value Chains

Where Trust Breaks, Opportunity Emerges

Written by Madelyn O'Farrell and Santosh Sankar, 2025-10-19

Summary

- Trust has become a binding constraint in global value chains as geopolitical volatility, fraud, and compliance complexity expose the fragility of bilateral relationships.

- Existing systems fail because trust is enforced through fragmented, document-driven, and retrospective processes that can’t operate across parties or respond in real time.

- Neutral, real-time, agentic infrastructure that verifies identity, provenance, and performance transforms trust from a cost center into a source of operational leverage.

Trust is the invisible currency that makes global value chains function. Every exchange—whether between manufacturer and supplier, shipper and carrier, or brand and consumer—relies on the assumption that information is accurate, counterparties are legitimate, and obligations will be honored. That trust is eroding amid heightened geopolitical conflict, rising nationalism, and an ongoing trade war that continues to fuel inflation. As a result, companies are revalidating commitments to key partners, reaffirming promises on service quality, and verifying the authenticity of goods.

At the same time, compliance burdens are increasing, bad actors are becoming more sophisticated, and supply chains are growing more complex. Without shared, verifiable systems of identity and provenance, those cracks are exploited. This creates opportunities to restore trust across four key domains: 1) Predictive Security & Risk Management, 2) Provenance & Compliance of Goods, 3) Freight Fraud, and 4) Detention. Across each section, you will notice themes of neutral infrastructure as a source of trust, continuous, real-time verification, and agentic automation as key to effective solutions.

Understanding the predictive security & risk opportunity

Risk in supply chains is increasingly multi-dimensional — geopolitical flashpoints, cyber spillovers, climate disruptions, and supplier defaults can all trigger cascading interruptions. Traditional security tools were built for static threats, but global value chains now operate in a world of constant volatility. Global Security Operations Centers (GSOCs) — the nerve centers tasked with protecting fixed assets, assets in motion, and key personnel — remain underfunded and reliant on manual monitoring. The problem isn’t just “spotting” risk — it’s acting on it before it disrupts business.

The cost of security and risk failures is measured not only in stolen assets but in business interruption. A single riot or protest can shut down distribution in a city for days, with ripple effects running into hundreds of millions in lost sales and added logistics costs. Power outages and grid instability routinely idle factories; in 2021, the Texas freeze caused $200B in economic losses, much of it tied to halted manufacturing. Natural disasters are equally destructive: hurricanes and floods regularly close ports and warehouses, costing $50–100M per day in delayed throughput at major terminals. Even localized disruptions compound quickly — one Tier 1 automotive supplier halting production for 48 hours can stop multiple OEM assembly lines, burning millions per day in downtime. These are not theoretical risks; they are recurring events that highlight the inadequacy of reactive monitoring.

Highlighting this dynamic is one of Orion’s (Fund III) customers, ServiceNow who identified asset and personnel security as an area of concern both for their operations as well as their customers. They’re rolling out Orion globally as a result.

Despite the size of the challenge, most organizations still rely on static playbooks and human analysts in under-staffed GSOCs. Alerts are noisy, context is missing, and mitigation lags behind the pace of disruption. This creates a reactive posture that’s both costly and ineffective.

At Dynamo, we believe the winners in predictive security will not just be “better dashboards” — they’ll redefine how risk is orchestrated, insured, and even monetized:

- From Monitoring to Orchestration. The key shift is away from passive alerts toward dynamic re-sequencing of operations — rerouting assets, adjusting production schedules, or pre-alerting insurers before disruption occurs. Think of it as moving from smoke alarms to fire suppression.

- Value Beyond Security. For decades, security budgets have been treated as cost centers. Predictive platforms that help avoid SLA chargebacks, preserve revenue, or secure insurance discounts will cross into CFO conversations, not just CSO budgets.

- Trust as a Network Effect. These systems get stronger with every new customer, geography, and signal. Platforms that build defensible, network-wide intelligence will enjoy a moat — a dynamic absent from compliance or detention tools, which are more bilateral.

- Agentic Force Multipliers. Predictive systems embed agents that filter noise, learn analyst preferences, and propose or trigger actions autonomously. That flips GSOCs from bloated monitoring centers into lean decision-making hubs.

- Market Creation, Not Just Substitution. Historically, only Fortune 1000 firms could justify in-house GSOCs. Affordable, AI-native, predictive systems open the door for mid-market enterprises to insource capabilities previously outsourced, expanding the addressable market.

Understanding the provenance & compliance opportunity

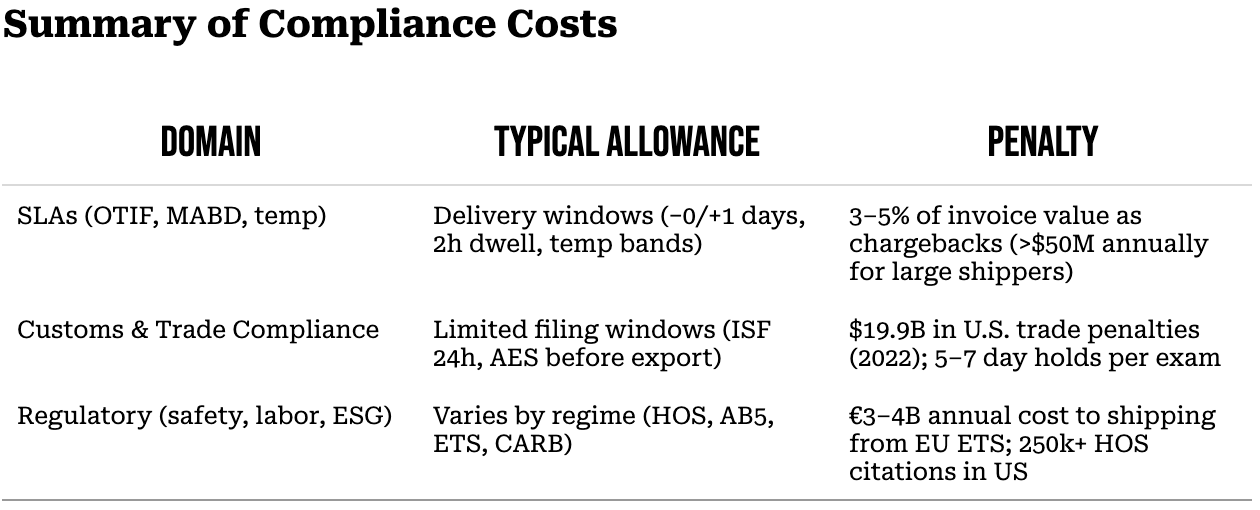

For global supply chains, compliance and provenance are two sides of the same coin. Compliance ensures that goods and operations meet contractual, regulatory, and legal obligations, while provenance verifies that goods are authentic, responsibly sourced, and transported with integrity. Both have historically been treated as back-office functions — paper trails built to satisfy auditors — but today they are operational chokepoints that can block freight in real time, expose companies to penalties, and erode brand trust.

The cost of getting compliance or provenance wrong is measured in billions. On the compliance side, US Customs and Border Protection issued $19.9B in trade penalties in 2022, while EU emissions reporting is projected to cost carriers €3–4B annually. On the provenance side, the OECD estimates counterfeit goods exceed $500B annually, with pharmaceuticals alone accounting for ~$200B in losses. Forced-labor enforcement is accelerating too — in 2023, over $1B in goods were detained at US ports under the Uyghur Forced Labor Prevention Act (UFLPA). Put simply: if companies can’t prove compliance and provenance, freight won’t move, claims won’t be paid, and customers won’t buy.

Consider Importal (Fund III) who is seeing customers increasingly come to them to handle not just customs but the broader regulatory burdens of compliance, such as labor, emissions, and also elements of provenance.

Both compliance and provenance still rely on fragmented, document-heavy processes. SLA tracking often happens in spreadsheets; customs brokers depend on static tariff tables; provenance certificates circulate in PDFs and emails. Blockchain pilots have failed to scale, and point solutions tend to solve narrow problems in isolation. This leaves systemic blind spots — precisely where fraud, regulatory failures, and counterfeit goods slip through.

At Dynamo, we see an opportunity for platforms that unify compliance and provenance into a shared system of verifiable trust:

- Network Effects Through Shared Infrastructure. Provenance & compliance becomes more valuable when multiple parties — suppliers, regulators, insurers, and customers — operate off the same records. Winners will be neutral “utilities” rather than proprietary silos, enabling systemic adoption.

- Financial Leverage Through Trust Data. Verified compliance and provenance records can unlock better trade finance terms, lower insurance premiums, and faster payments. Trust data becomes collateral, not just a regulatory requirement.

- Continuous, Contract- and Policy-Aware Monitoring. Compliance and provenance must shift from one-off document checks to real-time verification against SLA terms, trade codes, and regulatory policy.

- Agentic Automation. Software agents should continuously reconcile data across systems, flag exceptions, and resolve many of them — whether that means chasing down a missing Certificate of Origin, reassigning a load to avoid an Hours of Service violation, or pre-building an audit packet.

- Operational Upside. Embedding compliance and provenance into workflows reduces border delays, accelerates cycle times, and minimizes disputes — directly improving supply chain velocity and reliability.

The winners will be those who collapse compliance and provenance into one living system of trust — making verification continuous, automated, and auditable. While the pain today is felt most acutely in industries like retail, pharmaceuticals, and commodities with ESG scrutiny, the broader opportunity spans food, apparel, batteries, and industrial parts. Done right, provenance and compliance don’t just check boxes — they keep goods moving, protect brands, and unlock financial and operational value across the value chain.

Our thesis is reflected in our investment in Improvin’ (Fund II), which builds software for Measurement, Reporting, and Verification (MRV) for the provenance of the carbon footprint in the food supply chain, namely select grains.

Understanding the freight fraud opportunity

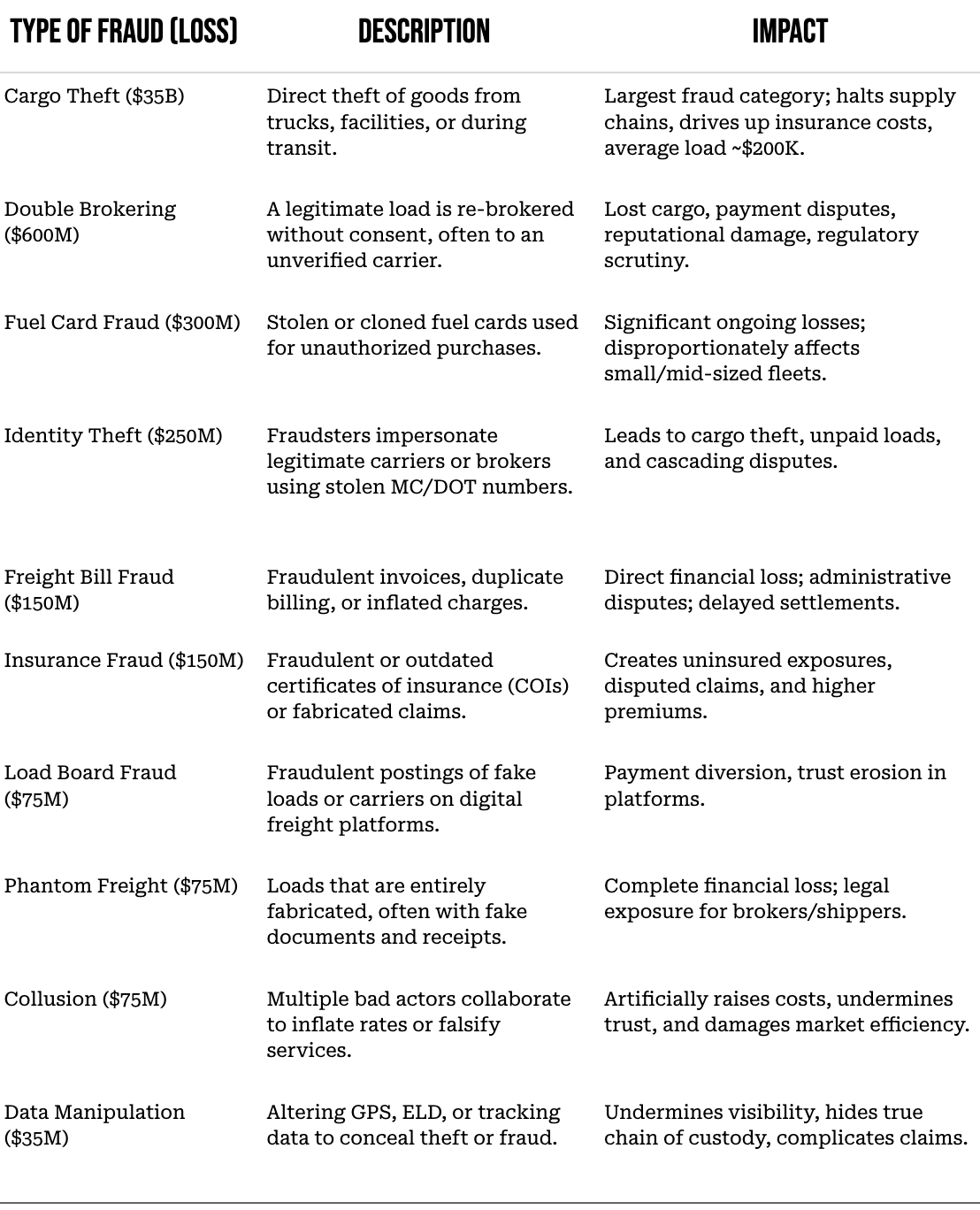

Fraud has long plagued freight markets, but the problem has accelerated with the rise of digital intermediaries and increasingly sophisticated bad actors. Freight fraud can take many forms: identity theft of carriers or brokers, double-brokering, fictitious pickups, fake insurance certificates, and outright cargo theft. The common thread is the exploitation of trust gaps in an industry where billions of dollars move daily, often between parties that have never interacted before.

The scale is staggering. Cargo theft alone is estimated at $15–35B annually in the US, with an average stolen load valued at $200K. Motor carriers are averaging $520K in annual losses, and logistics service providers $1.84M. Double-brokering and identity fraud are growing rapidly; the FBI and FMCSA have warned that fraudulent carriers are siphoning $500-800M from shippers and brokers each year.

The problem is no longer just operational — it is reshaping the insurance market. Cargo insurers are raising premiums, tightening underwriting standards, and imposing sub-limits or exclusions on high-risk commodities such as electronics, pharmaceuticals, and metals. Deductibles are increasing, while reimbursement is often delayed or disputed. In fact, surveys suggest as many as three-quarters of merchants self-fund losses because claims are denied or fall outside of coverage. The ripple effect is clear: fraud drives up costs across the chain, erodes trust, and leaves many loads functionally uninsured.

Earlier this year, we attended the Freight Fraud Symposium hosted by FreightWaves, during which Graham Gonzalez of Reliance Partners shared this sentiment:

“Freight fraud & cargo theft have become such a problem that they have replaced nuclear verdicts as the primary concern in the cargo insurance industry. As a result of the frequency and severity of the losses, insurers have had no choice but to increase premiums, hike up deductibles, and cap what can be covered for cargo theft within a policy, only adding to the pain felt by the brokers and carriers liable for the goods.”

Existing countermeasures remain inadequate. Load boards and broker platforms conduct basic credential checks, but bad actors exploit stolen MC numbers and fabricated documents. Insurance verification is often manual and slow. Visibility tools can flag anomalies in transit, but by then, the fraud has already occurred. Shippers and brokers rely on fragmented databases and gut checks — hardly sufficient in a market where fraudsters continually evolve tactics.

At Dynamo, we believe the winners in freight fraud will be those who rebuild trust through systemic verification and multi-party accountability. Four key concepts stand out:

- Multi-Party Handshake as the Foundation of Trust. Fraud prevention starts with a digital handshake between shipper, warehouse, and carrier — validating in real time that the right tractor, trailer, and driver are connected and verified. This creates the connective tissue for trust and could accelerate the adoption of trailer telematics.

- Unique Identifiers and System Integration. AI agents can pull data from TMS, YMS, and WMS to match unique identifiers for drivers and equipment at pickup. This approach closes trust gaps without displacing entrenched systems and can eventually extend across the full lifecycle of load interactions.

- Broader Platform Opportunity. Centralizing all load-related data — from location tracking, documents, and communications — reduces opportunities for manipulation. This would create a fabric that all parties can partake in when it comes to the movement of freight.

- Agentic Fraud Prevention. Agents can tap into this centralized data from load boards, ELDs, insurance databases, and carrier portals in real time — auto-flagging mismatched details, chasing missing COIs, or halting a suspicious load before pickup.

By closing trust gaps and reducing fraudulent losses, freight fraud solutions can restore confidence across the ecosystem — strengthening shipper–carrier relationships and creating positive knock-on effects in how insurers underwrite and price risk.

We are actively seeking solutions to back in this space, reflected in our Request for Startups.

UNDERSTANDING THE DETENTION OPPORTUNITY

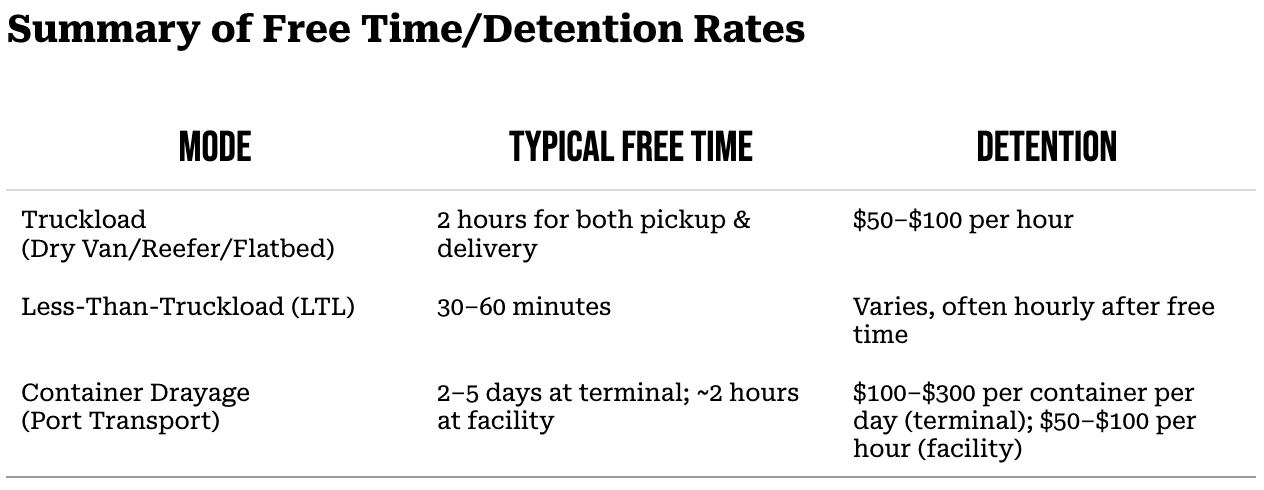

Detention is a contentious topic in transportation/logistics and occurs when a shipper holds a carrier’s truck and equipment beyond the agreed “free time” at origin or destination. Detention will accrue hourly after the free time period and is ordinarily paid out by the shipper or the receiver of goods who controls the warehousing operations causing delays.

It’s estimated that only 40-50% of detention charges billed are ultimately collected. This has to do with the complex dynamics between a shipper who ultimately has leverage over the carrier, broker (if it’s a brokered load), and even the receiving facility if the shipper contracts those activities to a 3PL. And so when detention is owed, shippers can often refuse to pay, as do their 3PLs, brokers might front payment for high-quality carriers/drivers they’ve brokered freight to, but more often, the carrier/driver eats the cost. It’s worth noting that longer dwell times tie up equipment, reduce driver productivity, and cascade delays across networks. What was once considered an occasional friction has become a chronic challenge in modern freight.

The costs are not trivial. Detention adds $3–4B annually to US freight spend in the form of fees, while US government data estimates that drivers lose an estimated $1.1–1.3B in wages each year due to uncompensated time stuck at docks. On average, one in five freight transactions experiences detention, often causing hours of unplanned downtime. Beyond the dollars, the inefficiencies are staggering: analysts estimate detention wastes 40–50M driver hours annually — the equivalent of pulling 25–30k drivers out of the labor pool. The problem is urgent because every additional 15 minutes of detention not only erodes utilization but also increases crash risk by nearly 7%, creating safety, insurance, and retention challenges across the system.

Despite its scale, detention is still managed with blunt instruments that are for location and status monitoring rather than dispute resolution. Billing often happens weeks after the event, based on subjective reporting rather than shared data. Visibility platforms can flag dwell times, but they rarely integrate billing, driver availability, or contractual terms in a manner that is neutral to all parties involved and therefore more trustworthy. The result is a reactive, fragmented process that fails to align incentives between shippers/3PLs, carriers, and brokers. We’d note that detention persists because of a few non-technical elements: fragmented scheduling systems, lack of dock labor predictability, and rigid appointment windows.

At Dynamo, we believe winning solutions for detention will not just streamline detention billing but create trust and alignment among shippers/3PLs, brokers, and carriers. Key ingredients include:

- A Neutral, Switzerland-Like Platform. Detention disputes often come down to “he said, she said.” A single, trusted system that all parties can access — and which is not controlled by any one stakeholder — can serve as the neutral recordkeeper.

- Unified Communication and Documentation. Today, detention records are scattered across emails, texts, load boards, and invoices. Winners will consolidate all comms, documentation, and operational data into one environment, eliminating silos and reducing opportunities for dispute.

- Contract-Aware, Real-Time Visibility. Solutions must track dwell time in the context of each load’s contract. The clock doesn’t start when a truck arrives — it starts when free time ends, and that’s variable by contract. A winning product needs to be contract-smart, not just timestamp-driven.

- Automated Financial Workflows. Instead of weeks-long disputes, billing and resolution should be instant. Smart contracts or automated invoicing tied to verified detention events can collapse cycles from weeks to hours.

- Network-Level Optimization. This is not about vague “integration.” It’s about embedding detention management into adjacent workflows like yard management, dock scheduling, and fleet optimization. If a platform knows that a truck is about to hit its detention clock, it should be able to re-sequence dock priorities, reassign equipment, or alert dispatch — before charges accrue. That’s where detention management moves from a penalty to a proactive efficiency lever.

The winners in detention will be those who transform it from a recurring dispute into a shared system of accountability and efficiency — protecting driver livelihoods, giving shippers predictability, and unlocking capacity across strained freight networks.