AI in Freight Brokerage

LLMs will provide much-needed leverage to the freight brokerage industry if executed on correctly

Written by Jon Bradford, Santosh Sankar, and Madelyn O'Farrell, 2024-10-11

Summary

- Freight brokerage sits at the intersection of AI acceleration and a historic freight downturn, where collapsing margins and rising complexity make cost-to-serve the defining battleground.

- The winning model requires a clear wedge into low-skill back-office workflows, a human-in-the-loop system that learns from exceptions, seamless integration into existing processes, and a services-based pricing model aligned to per-load economics rather than rigid SaaS fees.

- We incubated FreightHero to embody this recipe—with a vision to own the operational back office with AI agents, embedding human oversight to train toward autonomy, integrating directly into incumbent workflows, and aligning pricing to cost-per-load to structurally lower cost-to-serve for brokers.

As specialist investors in industrial, supply chain, and mobility topics, we have been buffeted over the last 12 months by both the acceleration of AI in white-collar work and the prolonged freight recession where trucking volumes and rates remain at near-historic lows.

While everyone is learning more about the true potential of AI and how to build AI-native businesses, it has become increasingly clear that service-heavy models that were previously the haunt of private equity are now ripe for investment by venture investors such as ourselves.

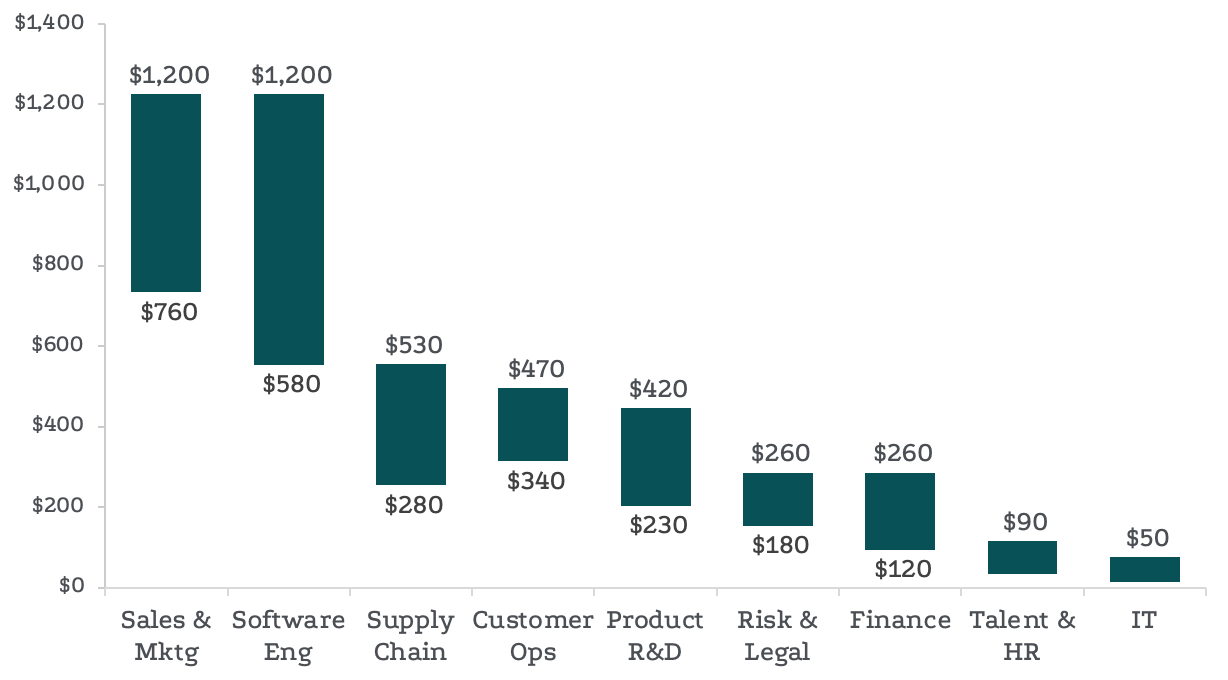

If you recall from our 2023 AGM, we shared data from McKinsey that estimated LLM opportunities in the supply chain could be worth between $280B and $530B (as below). Sitting in the crosshairs of this opportunity is the North American freight brokerage industry that we’re uniquely qualified to build into given our domain expertise, experience, and networks.

LLM BENEFIT ON BUSINESS FUNCTIONS ($B)

Source: McKinsey.

The State of the Domestic Trucking Market

Freight brokerage is at a juncture in which the industry is desperate for methods to protect margins. As consumer demand has fallen from the pandemic highs and the zero-interest rate era, excess carrier capacity (which is still 37% greater than pre-pandemic levels according to TD Cowen) has created depressed freight rates for multiple years. While it has squeezed the trucking carriers themselves, the freight brokerage industry has not been spared.

According to Brush Pass Research, as of August 2024, over 3,000 freight brokerages have exited the market which is down 10% YoY and marks the 19th consecutive month of declines. While this is welcome to some degree given how overbuilt the industry became from 2020-2022, it is the second worst period for the industry since 2013. As a result, the current period is now considered the Great Freight Recession, and should it not improve within the coming year, it is likely to be known as the Great Freight Depression.

All said, there are signs of improvement for the industry. The recent 50 bps interest rate cut and the accelerating trend of nearshoring driving domestic manufacturing growth are positive indicators. As shipping complexity increases, it drives a reliance on freight brokerages, another tailwind for this segment. Research suggests over 20% of loads are now brokered (vs 6% in 2020).

According to Armstrong & Associates, the US freight brokerage market totaled $20B in industry-wide net revenues in 2023, representing >15% of the total logistics and transportation 3PL market in the US. The market is highly fragmented with over 26,000 brokerages registered in the US according to Brush Pass Research, with the largest player, CH Robinson, controlling no more than 15% of market share. Other noteworthy players include TQL, RXO/Coyote Logistics, and Landstar. The scale of these players allows them to invest in technology — both home-grown and externally sourced — in a manner that is typically inaccessible to the long tail of the freight brokerage industry.

When considering the pressure on brokers today to protect margins, the market tailwinds, and the technological gap— particularly for small to mid-sized players—we believe we are at the forefront of a massive opportunity for solutions that can effectively address this industry's needs.

Understanding the Role of Freight Brokers

Before proceeding, let’s explain what a freight broker actually is. Freight brokers are the intermediaries that quarterback the shipment of goods via truck and/or train modalities. They ensure goods get from Point A to Point B on time, within cost, and safely by handling all communications and coordinating the physical movement between shippers (people who’re moving the goods like AB Inbev) and carriers (trucking companies like Schneider National), as well as warehouses on the sending and receiving side. While there are highly complex and nonstandard elements to managing certain loads, by and large, the processes are highly automatable barring the handling of exceptions. This has resulted in the industry embracing low-cost offshore labor for the last decade-plus - otherwise known as BPO (“Business Process Outsourcing”).

Business Model

At the core, the freight brokerage business model is simple: the company earns the difference between what is quoted to the shipper (Gross Revenues) and the cost of transportation that is negotiated with the carrier (COGS). The margin (or take/net revenues) should pay for operating expenses as well as reinvestment in the organization. The historic margin was 10-20% but continues to face pressure with 10-15% being more common. The key for a freight brokerage is to operate and service the freight in an economically viable way (minimize OpEx) while upholding strong customer service levels- which is truly the only differentiating factor in the industry.

It is worth noting that a freight brokerage’s margins can be quite volatile as volumes and rates are dictated by the broader freight market and seasonality. As a result they tend to avoid fixed costs such as SaaS; preferring to align expenses to a variable basis.

The Cost to Serve

The “Cost to Serve” is the total expense of servicing a freight load. In speaking to industry executives, there is a renewed awareness around this metric and determining ways to invest in both process and technology where the cost to serve is reduced on an ongoing basis. At the crux of this metric, we believe there exists a massive opportunity as outlined below.

The Major Operating Models

Today, brokerages typically fall within two models: Cradle-to-Grave (“C2G”) or Split. In C2G, the broker owns every aspect of the shipment, from securing the freight from the shipper to finding a carrier, negotiating rates, tracking the shipment, and ensuring successful delivery. They are also responsible for building their own book of business by acquiring new shippers and sourcing new carrier capacity. Both of the aforementioned elements are central to the commission an individual broker earns.

In a Split model, the sales and operations are divided into multiple separate departments - think of it as a manufacturing line where the widget (a load in this case) is passed to the next station so that a specialist can do their part within the broader organization. Commission is still a key incentive for the individuals handling a load and split in various ways across these departments.

However, regardless of the model, the workflow (and associated % time) from when a shipper requests a shipment to its delivered and settlement payment is as follows:

- Rating & Quoting (20%)

- Carrier Sales Sourcing (25%)

- General Operations i.e. scheduling, track & trace, etc (30%)

- Financial Operations (15%)

- Selling (10%)

The Drag on Cost to Serve

Dynamo has spent the last nine months interviewing over two dozen freight brokerage executives of various shapes and sizes to better understand their workflows, pain points, and opportunities for value creation. What is common is that brokerages across the spectrum face the burden of operational work. Depending on the brokerage, firms reported that 50-90% of their time is spent on rote, back office work. This increases the cost to serve while limiting a broker's revenue generating capacity.

We found it interesting that brokerages often found it difficult to pinpoint their exact cost to serve per load due to a lack of proper telemetry to attribute costs to workflow. Our conversations indicate that a well run brokerage who is forward thinking around process and technology has a cost to serve of $100-$120. However, ranges of $140-$160 are more commonplace. Lastly, it was shared with us that certain digital freight were able to demonstrate a cost to serve as low as $75 in certain segments of their book.

Ten Year Look-Back on Technology in Brokerage

Before diving into the opportunity before us, let’s briefly reflect on the last ten years of technology investment in this industry which has led to this point. If we look at the first generation of digital freight brokers, each company went full stack and competed directly against the incumbents.

The most well-known was Convoy, which came to a sudden end. However, its downfall was not due to its technology or operational efficiency, which were considered best-in-class and is now seeing a reboot under the Flexport brand. Its demise was due to over-raising alongside a large base of fixed assets funded by meaningful amounts of debt that made the company unsustainable once venture dollars dried up.

The other noteworthy player in the space was Transfix who exited their brokerage operation (retained their TMS to be a pure SaaS business) to NFI with a cost to serve in the range of $75-100 per load.

This first generation of startups and technology created efficiencies in the following three stages.

- Digitization. In the first stage, they adopted modern digital workflow tools - in the case of freight brokerage, a TMS - thereby adopting best practices, gaining more robust data infrastructure, and improving interoperability. As operations become more digital, it increases observability around efficiencies and costs.

- Optimization. After digitization, operators can observe and test new ways to reduce operational costs and customer service. Examples include modern routing tools, rate engines, and load matching.

- Automation. Finally, as operators optimize their processes, this opens the door to ultimately automate the work itself. However, such automation efforts were relatively fragile, costly, and unable to handle the variations that are common to handling freight. This is where we saw efforts around Robotic Process Automation (“RPA”) as well as offshoring back office to reduce the cost to serve.

While we understand the rationale for initially adopting this full stack approach, the larger (and overlooked) opportunity is building tooling for the incumbent brokerages to accelerate their operational capabilities, reduce the cost to serve, and improve customer service.

LLMs Are the Harbinger of Efficiency

We believe that Large Language Models’ (“LLMs”) ability to parse disparate data sets, draw relationships and understand context, and quickly learn how to handle dynamic workflows will enable the most meaningful evolution in freight brokerage since its inception in the early 80s through automation rather than optimization.

Brief Primer on LLMs

LLMs are a class of AI that are trained on vast amounts of data to learn patterns and structures. Using multiple layers of computation called deep learning, LLMs can understand grammar, context, and nuances. The LLM acts as a sophisticated prediction engine, trained on extensive datasets to learn statistical properties, and can adjust internal parameters to minimize prediction errors. Over time, they generate coherent and relevant text, translate languages, answer questions, and even automate entire parts of workflow (such as writing code for integrations into a TMS).

Models like ChatGPT, Claude, Llama, et al can be pre-trained and fine-tuned for specific industries or firms. From our experience working with startups such as Raft AI (Fund I) and Importal (Fund III), multiple models are required to solve complex problems and handle the multi-modality (AI-talk for the varying data types both as inputs and outputs). It’s worth noting that there’s still a level of inexplicability around outputs. This is an area being actively researched and addressed at present using a concept called Retrieval-Augmented Generation (“RAG”) as well as a “human in the loop” in some instances.

The quality of a model's predictions improves with more diverse training data and complex architecture. We expect models to specialize in specific outputs (text, video, images) and for the varying foundational models to achieve similar performance levels over time. The key differentiator will be the data a user brings to the table to fine-tune the model, emphasizing the importance of organized data. For startups, focusing on proprietary data and having a strong competency to stand up integrations and interfaces lend themselves to building a data flywheel that’s crucial for building defensibility.

Ingredients for a Successful Recipe

While we don’t claim to have all the answers for what will ultimately win in this market, we do believe there are key elements for success:

- “Human-in-the-loop”: Freight brokerage is a business of exceptions, where brokers spend their days dealing with shipments that aren't picked up, drivers who go unpaid, or accidents that occur. An AI solution must maintain a “human-in-the-loop” who can handle exceptions and help train a model(s) to manage the majority of loads in an automated fashion. This provides the model with a high quality data input to learn from. Over time, the model learns how to handle these cases, continuously tipping the scale towards full autonomy. To realize this, we actually think in the early days a startup might look like a tech-enabled BPO.

- Own the Back Office Workflow: We believe the initial wedge should be low-skilled workflows. These are the tasks often outsourced or offshored such as scheduling or track and trace. To achieve a venture-scale outcome will require expanding into other workflows and ultimately owning the entire operational back office (think Carta for Freight Brokerage).

Regardless of the wedge, it must be a seamless drop-in replacement to existing workflows and cost centers that the brokerage has already in place. This means, in the case of scheduling for example, the end user is simply seeing the schedule get completed in the same way they would with a BPO or even an in-house employee. The fact that it is AI is irrelevant to the user. The value resides in lower costs and reduced burden on employees, enabling greater value creation and addresses the concerns we heard during customer discovery that solutions are emerging as point solutions rather than handling end-to-end workflows.

- Services not SaaS: The business model structure for this approach is paramount. Seasonality and volume fluctuations make a recurring SaaS or per headcount fee uncomfortable, whereas pricing per load is more acceptable which brokerages are already familiar with.

By removing the burden of menial steps in the workflow, brokers can benefit from a reduced cost to serve and also focus on the revenue-generating and relationship-oriented functions of the role that are also more fulfilling.

Meet FreightHero

Having looked at multiple opportunities in freight brokerage combined with LLMs, we felt that either the team lacked the “chops” needed to make this a success or they lacked the insight and customer understanding of how to build tech for the various segments of the freight brokerage industry. As a reminder, we have deep subject matter expertise and networks in the freight brokerage drawing from investments in Steam Logistics and Sennder as well as “the Access America Transportation mafia” to address this gap.

With this thesis in hand, we are excited to announce our collaboration with AI Fund to bring this solution to market. We are currently undertaking the search for a Founder-in-Residence to lead the charge. We have a number of candidates at a late stage in the search process and hope to make an announcement in the New Year when the business emerges from stealth.