Welcome to the "Old Norm" of 2023

It was a difficult year in supply chain but ultimately returning to a level much closer to the long term average

Written by Santosh Sankar and Jon Bradford, 2024-01-20

Summary

- 2023 marked a return to the “old norm” in logistics: transportation costs normalized back toward 2018–2019 levels—good for shippers, painful for carriers, brokers, and forwarders.

- Volatility didn’t disappear—it just rotated: Red Sea disruption, Panama Canal constraints, China eCommerce airfreight demand, and a prolonged trucking recession created uneven pressure across modes and services.

- Our 2024 view is cautious but opportunistic: prioritize cost-to-serve, retention, and contract discipline, and lean into LLM-powered services and drop-in automation that reduces labor—especially in transactional business models where buyers want an “easy button,” not another SaaS seat.

Overview

Following on from our previous opinion piece in Q3 2023 that was focused on the broader US interest rate environment and related economic impact, we felt it was important to do a review of the US supply chain in 2023 and establish our expectations for 2024. We’d note that it’s worth reviewing our Q3 2023 commentary as it will help color our perspective about the broader economy and both consumer and industrial demand which is a key driver in supply chain.

Since publishing our previous opinion piece, there has been a bullish sentiment from many of the capital markets stakeholders with multiple interest rate cuts expected and now priced into the market. However, in early January the headline CPI jumped to 3.4% in December 2023 which was up from 3.1% in the previous month, and exceeded expectations of about 3.2% (we recognize policy makers prefer core inflation which excludes energy and housing). As we had highlighted last quarter, we’re not out of the woods when it comes to inflation and it’s our expectation that The Fed is likely to be more hawkish, even though they have signaled otherwise, when it comes to rate cuts given the criticism that they received for not initially hiking interest rates fast enough. While inflation is slowing, it is not within target range for the Fed (being less than 2%).

We still remain cautious about core drivers in consumer and industrial demand through 2024 with the expectation of mixed messages around the state of the economy continuing through the election year.

For those who are not interested in reading any further the TDLR is “welcome to the ‘old norm.’” Overall transportation costs have returned closer to those in 2018 and 2019. Good for shippers, not so good for carriers and other logistics service providers.

Ocean Shipping & Forwarding

2023 was the year that container freight rates came back to earth from their “bitcoin-like” highs of the previous two years, as can be seen below.

Source: Apollo

This had a double “sucker punch” effect on revenues for freight forwarders who suffered from reduced rates (as above) alongside reduced demand (read volumes) from pandemic highs. It was not a pretty year for freight forwarders and this likely influenced Flexport’s decision to bring its founder, Ryan Petersen, back into the CEO role.

This overall price squeeze has reduced revenues and brought the need for greater automation and reduced labor, that has been largely dismissed over the past couple of years as demand was plentiful. As we previously mentioned, the adoption of Large Language Models (“LLMs”) definitely has a role to play in service-oriented, transaction-centric business models.

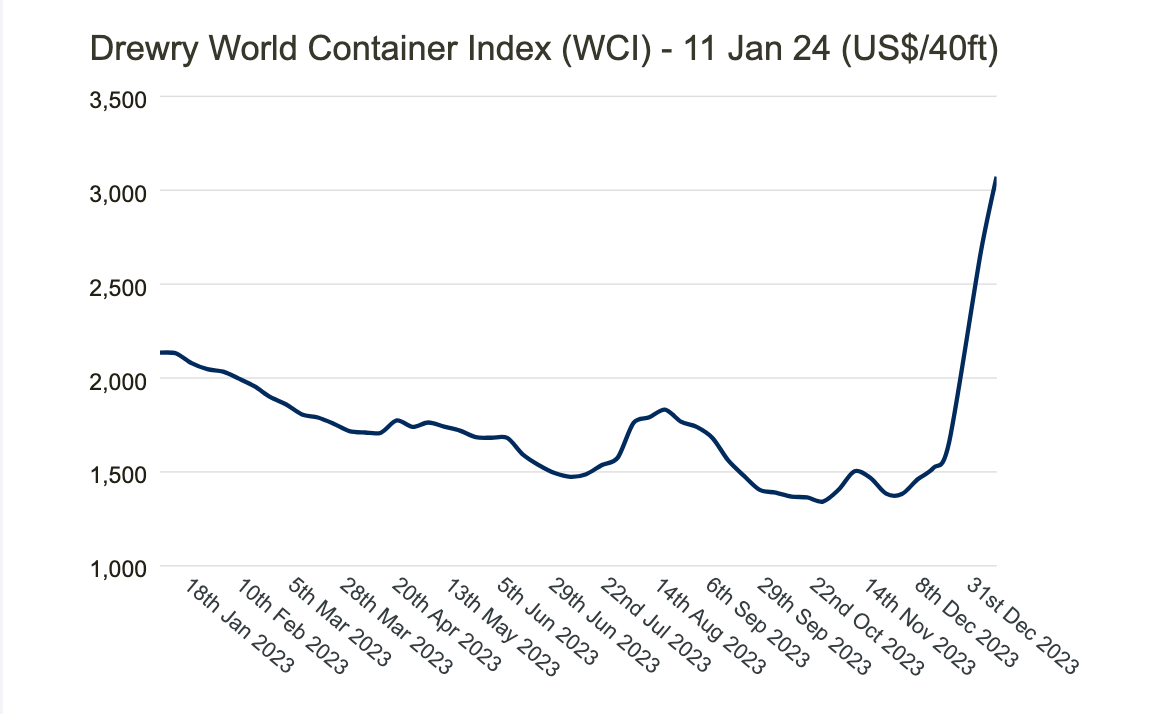

It had been our expectation that rates would not change significantly in 2024, however the spill over from the Middle East conflict has caused a spike in prices over the last few weeks as can be seen below.

Source: Drewry

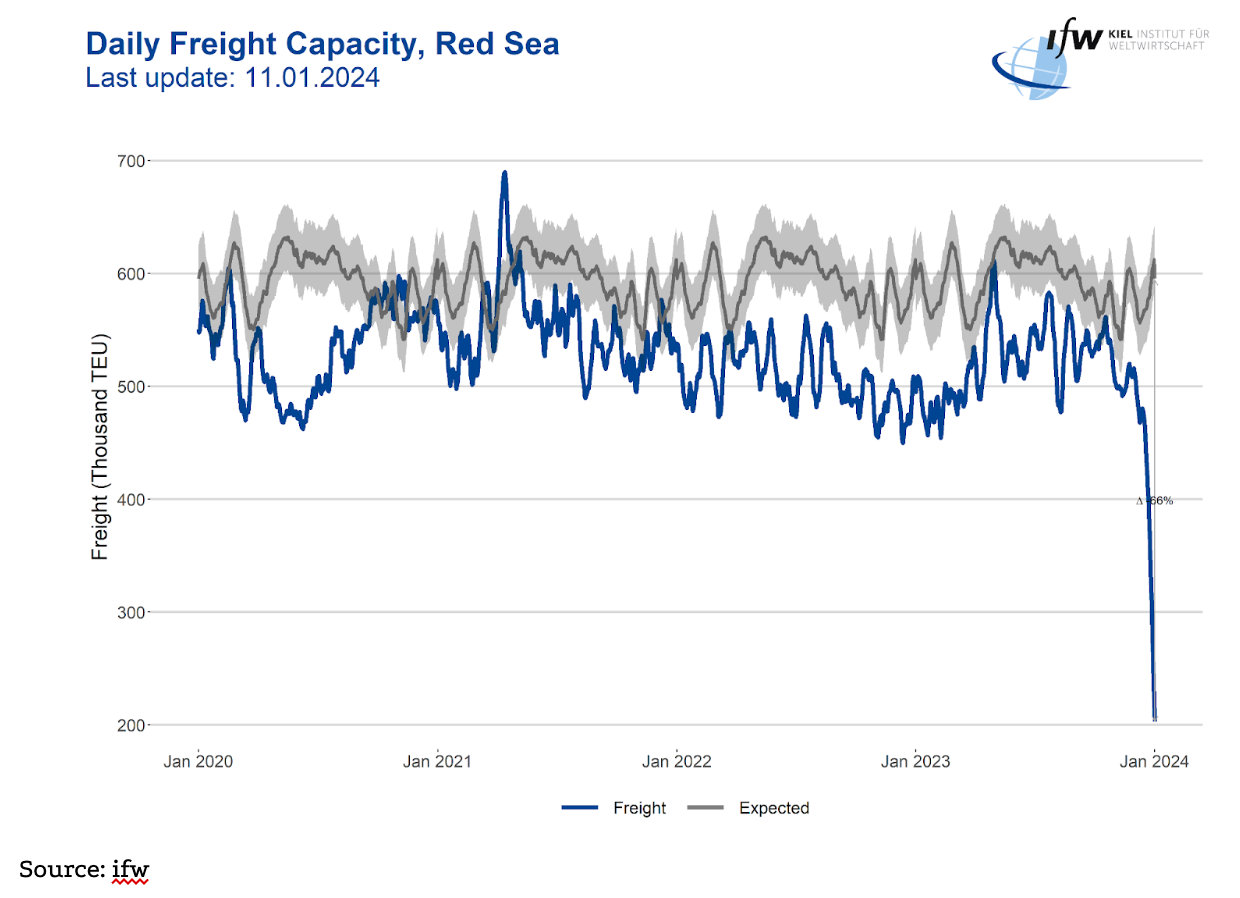

As we write this opinion piece, there has been an intervention by the international community, but shipping traffic through the Red Sea and Suez Canal remains at a standstill (as below).

Source: ifw

It is unclear when (or if) a resumption of shipping through the Suez Canal will return to the norm, and its potential impact on Middle East exports of oil and related distillates. Given the importance of the shipping channel and the risks of energy prices spiking again, it will have the full attention of the western nations with the backdrop of a fragile economy and inflation both in the US and Europe. Diverting shipping traffic around the Cape of Good Hope (rather than through the Suez Canal) will typically add five days to the journey, which will increase both the cost and demand for containers.

As transit times go up, companies will be inclined to order "a bit more" to add to buffer inventory. This allows them to safeguard from stockouts as a result of delays or rolled cargo. Demand isn't ripping like in the COVID times, but it is inching up. While conditions have us on “bullwhip watch” it is premature to call it thus since most geopolitical analysts believe the tension will last longer than we’d like and is likely to worsen before it improves.

It is also worth noting that the Suez Canal is not the only bottleneck in the ocean container market. Droughts continue to cause water level problems with the Panama Canal due to climate change issues. Normally, about 36 vessels a day pass through the Panama Canal, at present, there are only about 22 moving through it. For reference, 40% of all US container traffic operates through the Panama Canal and low water levels continue to benefit US west coast ports who lost a share of volumes during COVID.

Overall, we believe that ocean container rates will recover (based upon the above) but they will remain highly reliant upon the US economy continuing recovery. A slowdown caused by a spike in inflation is likely to suppress rates.

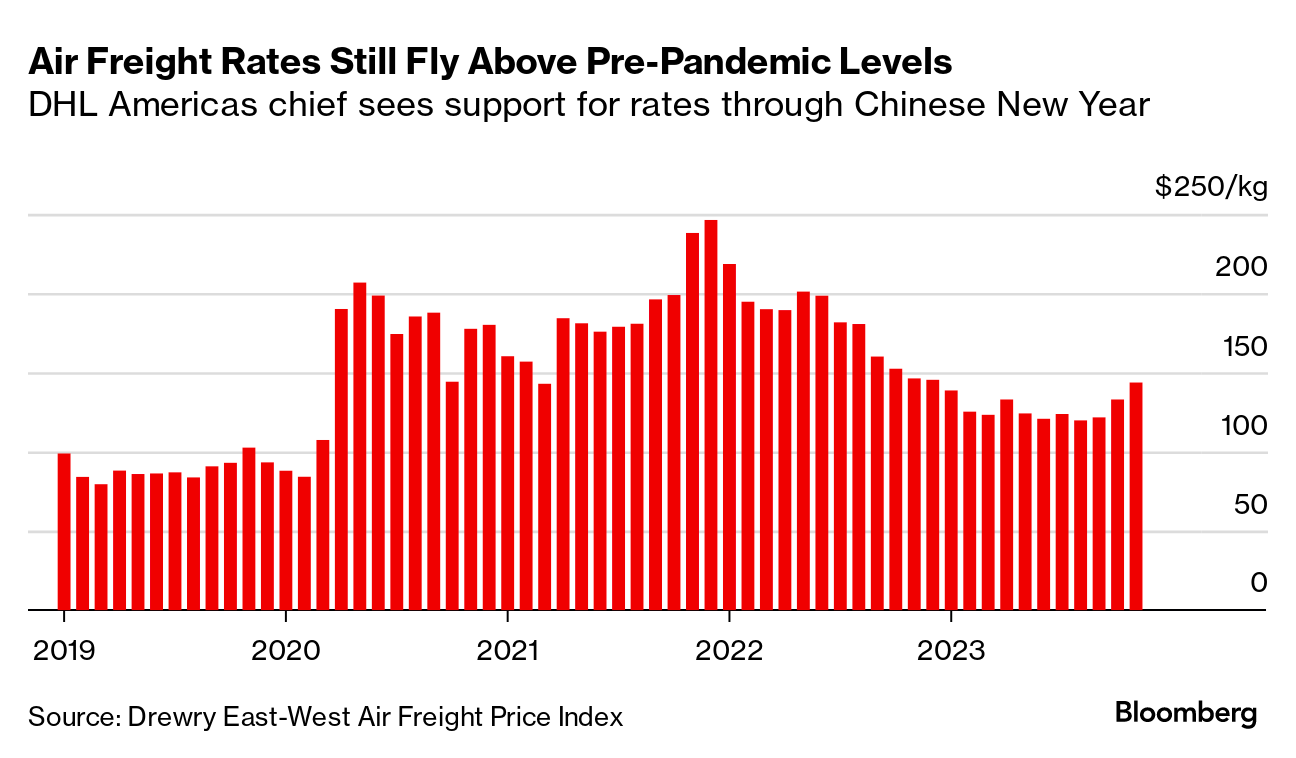

Air Freight

Air freight rates stabilized during 2023 at about a discount of 50% to the 2022 peak. However, 2023 rates remain higher than at the previous pre-pandemic levels. Unlike other modes of transportation, air freight is typically booked in advance to protect availability (particularly during peak periods) and is not subject to the same fluctuations that you might expect to see with other modes of transportation.

Source: Drewry East-West Air Freight Price Index, Bloomberg

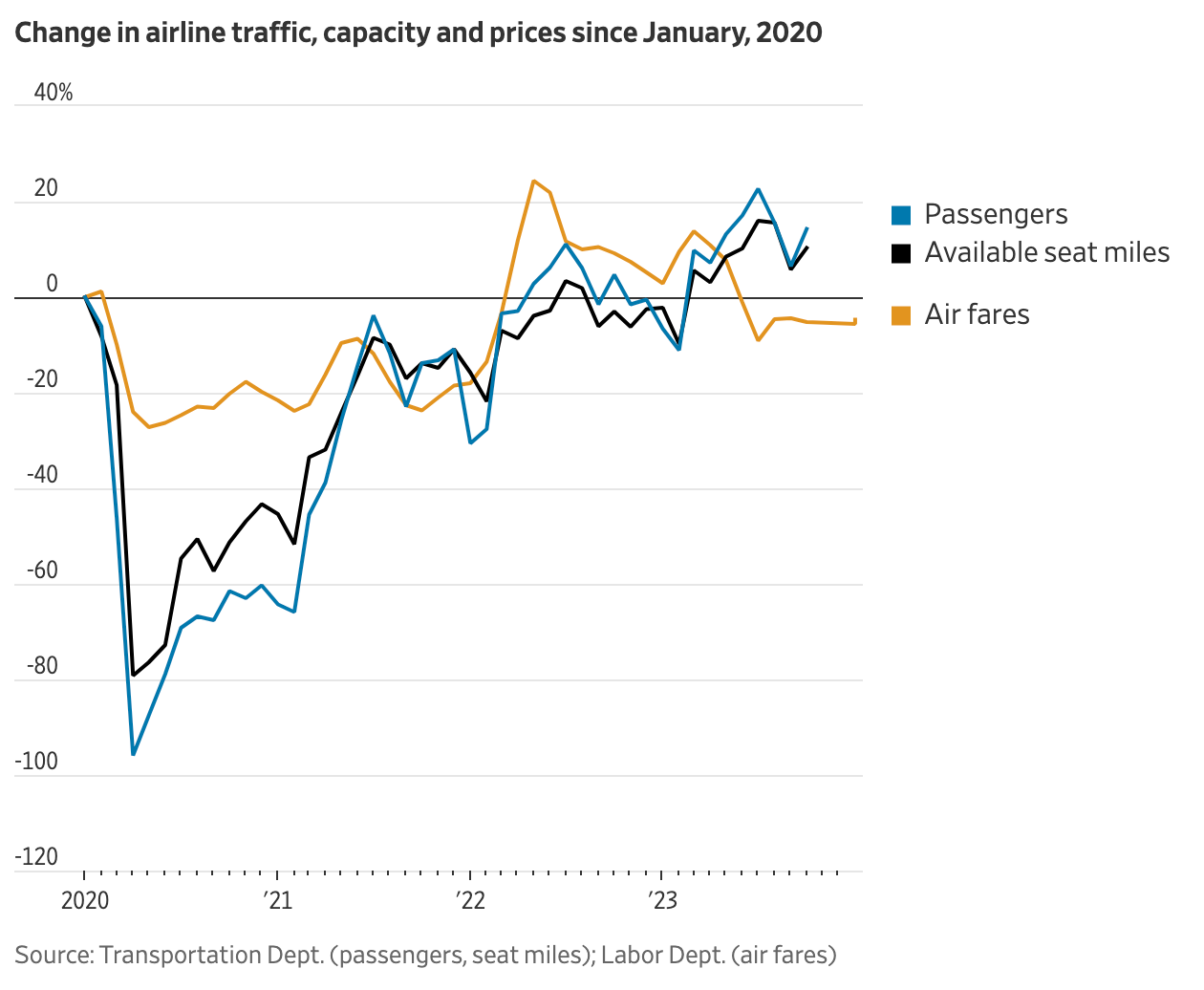

It is also worth noting that there has been a substantial increase in airline passenger capacity over the last 12 months which is highlighted below, and there are now almost 20% more passengers traveling than prior to the pandemic, which increases overall capacity in the “belly of the aircraft” for additional air freight.

Source: US Department of Transportation, US Department of Labor, WSJ

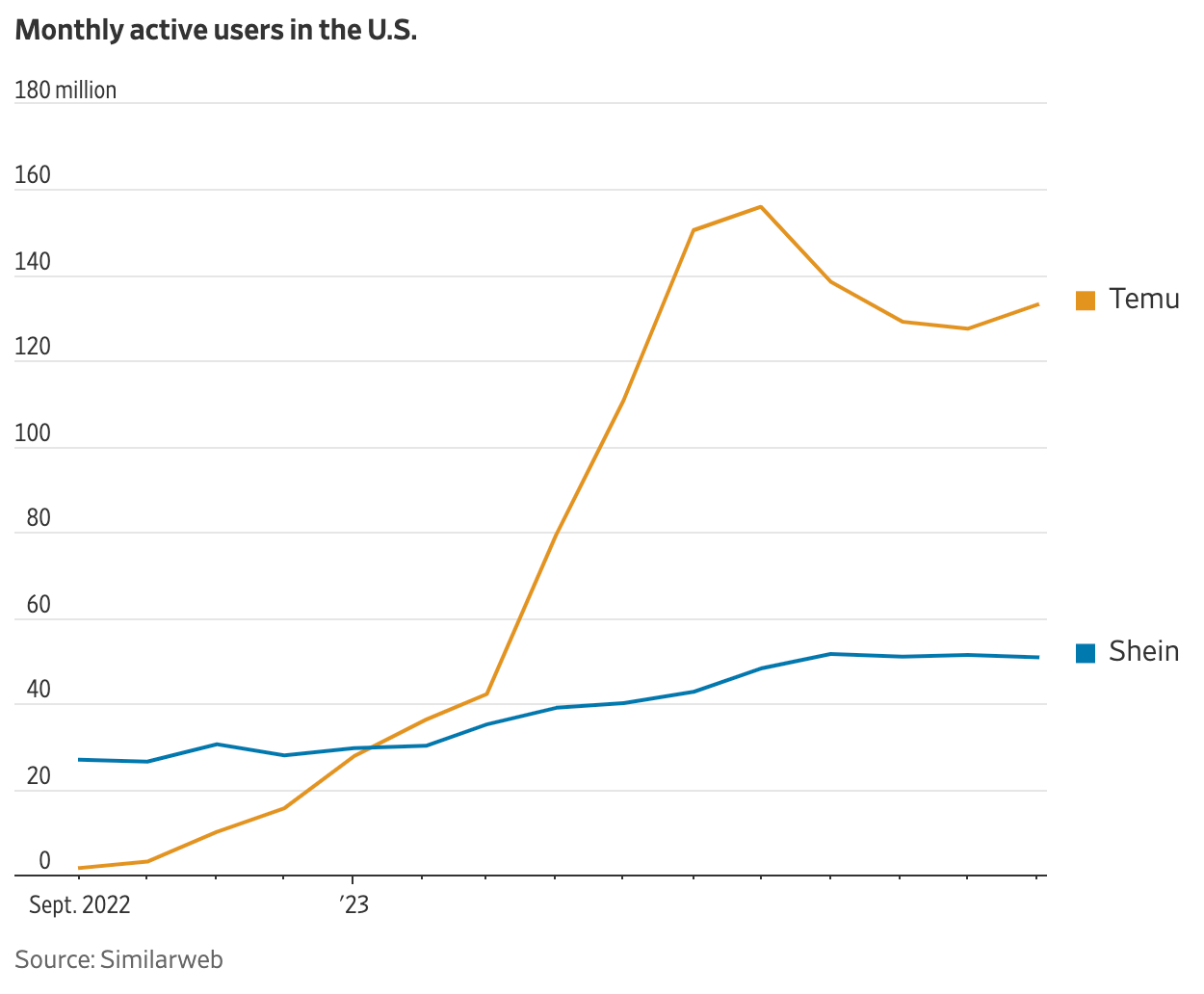

Air freight rates are not expected to materially change during 2024 with capacity coming back online. It is worth flagging a new demand-side phenomenon that has emerged late in 2023 with a massive increase in demand in the US for big China-based eCommerce (Tik Tok, Shein and Temu) that could offer upside in volumes and rates, alike.

As can be seen below, there has been an explosion in active users for Temu in particular.

Source: Similarweb, WSJ

Temu and Shein are an online marketplaces that sells products at an incredibly low price, offering inexpensive made-in-China goods, from t-shirts and handbags to electronics and kitchen items. They have turned the eCommerce supply chain upside down with their on-demand business model that fulfills straight from the factory.

They place orders to Chinese suppliers to be delivered in days, and rely on real-time data to analyze demand and replenish orders as needed. That cuts down on the need for storage and limits inventory risk. However, they can place significant inventory risk on the Chinese manufacturers.

For reference, these two Chinese shopping platforms each ship up to one million packages a day in the US according to ShipMatrix. These are twice as much as televised shopping channels QVC and HSN. According to Shien’s website, 76% of US customers get their orders within 10 days. This can only be achieved by shipping pallets via air freight which are trucked to parcel carriers facilities. While capacity is opening up as we mentioned before, it is quickly being soaked up by eCommerce demand.

It is important to flag that both Shein and Temu benefit from the $800 de minimis rule which bypasses duties and taxes on goods valued at less than $800 when importing customer merchandise from overseas. The conditions under which many of these products are produced remains unanswered with politicians both in the US and Europe calling for greater transparency.

Trucking & Brokerage

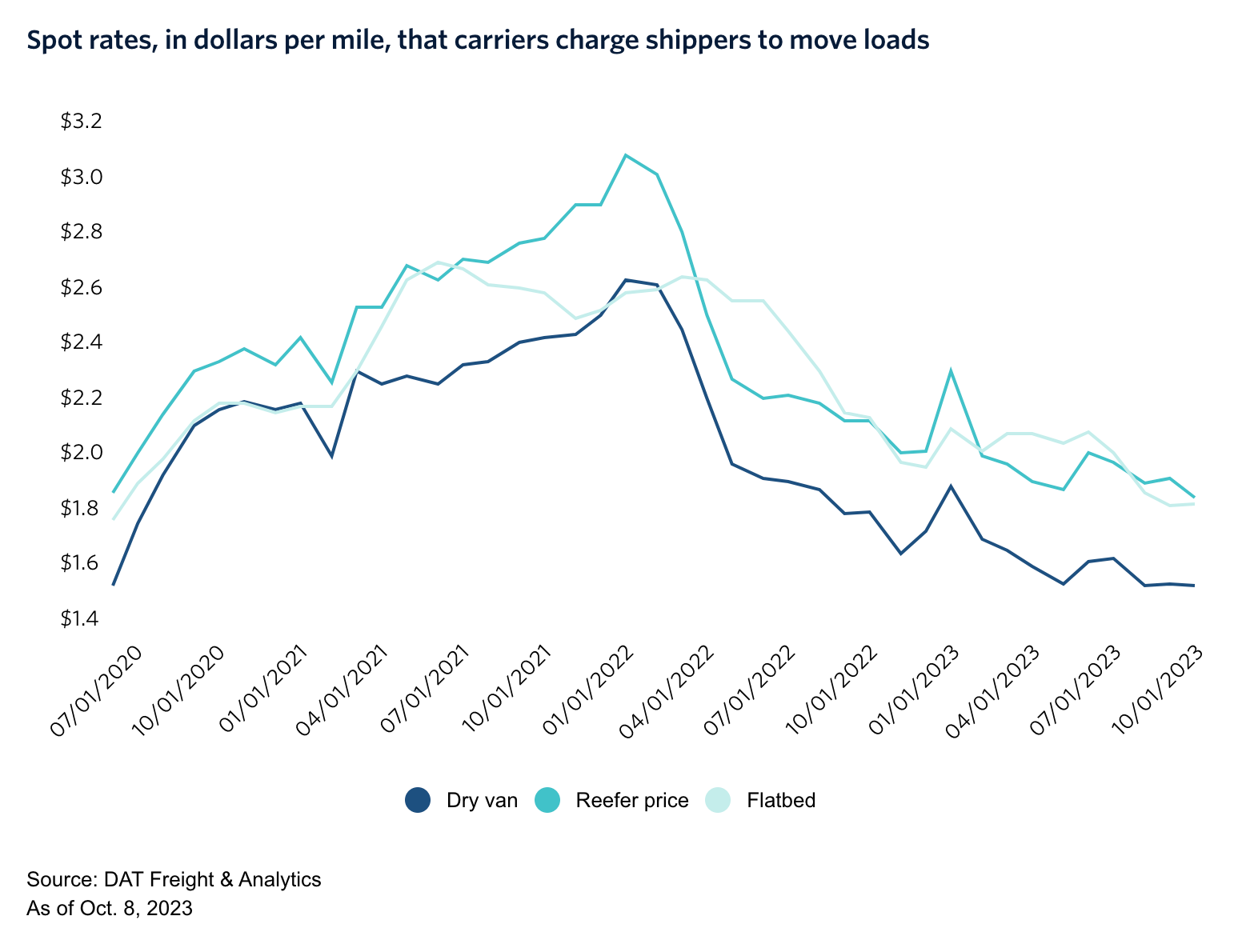

2023 was not a great year for the trucking industry. Most insiders say it was the worst year on record since deregulation in the 80’s. The first half of 2023 saw the continued decline in full-truckload rates reaching 7-year lows. What made it worse was that 2023 felt more like a “sugar crash” following a “kids party” after everyone overindulged with one too many packs of candy and pop over the previous two years.

Source: DAT Freight & Analytics as of Oct 8, 2023

This forced carriers to make a decision to either chase low margin market share to maintain utilization for their fleets to break-even or take a hit and focus on profitable business. This is where Convoy got caught in the crossfire. After years of aggressively chasing market share with minimal to no margin, the collapse of the spot rates left it with no choice but to focus on profitability. However during the peaks of the previous couple of years, Convoy had shifted its “asset-lite” model to acquire trailers financed by debt.

This sudden contraction while holding debt financed trailers flipped the business on its head - ultimately leaving the bank in charge who pulled the plug on it in the last quarter of the year. The next chapter of Convoy is yet to play itself out with Dan Lewis, Convoy’s CEO, joining Flexport after the acquisition of its technology, considered to be industry-leading in brokerage. Ultimately, the sudden changes in the market and the acquisition of physical assets led to Convoy’s downfall, not the technology that it built over its lifetime.

During the second half of 2023, the market had fits and starts where people think it might be begging to stabilize. We note that several industry participants ranging from freight brokers, insurance agents, and shippers speculate that there is still excess capacity (largely small owner/operators) that needs to leave the market before rates return to healthy levels. Additionally, it’s been noted that several brokers are in a precarious position and given the reliance on factoring in the US, there could be meaningful credit losses stemming from such a collapse.

That said, we think there will be a slight recovery by the end of 2024 which could be supported by restocking activities after a 2023 effort to liquidate excess stock. Adding to this are one-off safety stock build ups in response to the Red Sea crisis (granted, this is more likely in Europe than the US).

The only bright spot in the trucking industry was Less Than Truckload (“LTL”) which remained relatively stable. However, this was more a function of Yellow Corp, a 99-year-old company, filing for bankruptcy. Yellow was the US’s third largest LTL carrier with 8.6% of the market share and thereby reduced capacity in the market.

Intermodal/Rail

The intermodal/rail sector in the US started off slow in 2023, experiencing a decline from 2022 that followed us into Q1 2023 (leading to the lowest January performance since 2013). Despite a slump in demand lasting until July 2023, the latter months saw an improvement as safety issues were addressed and labor negotiations with the unions were finalized.

This uptick in intermodal traffic can be partially attributed to new cross-border services from Mexico, potentially diverting some cargo from trucks to rail. However, cross-border rail operations, especially in critical Texas markets, are still vulnerable to interruptions. Note that capacity is limited with Canadian Pacific Kansas City and Ferromex, with its various alliances, being the two major operators of this lane.

In 2023, disruptions were notable when Ferromex, a Mexican railroad company, had to halt services due to the closure of the Eagle Pass border crossing by US Customs and Border Protection in September and December. This was in response to increased migrant activities and significantly impacted Ferromex’s customers.

Intermodal pricing, while relatively stable, typically operates at a 15-30% lower cost compared to truckload. Looking ahead, intermodal transport is expected to play a significant role in North American industrial supply chains across the Mexico-US border with the growing trend of nearshoring in the region.

It is unclear whether 2024 will see the full impact of such demand coming online, but the supply/demand dynamics favor higher pricing which benefits carriers and brokers in the long-run.

Warehousing & Fulfillment

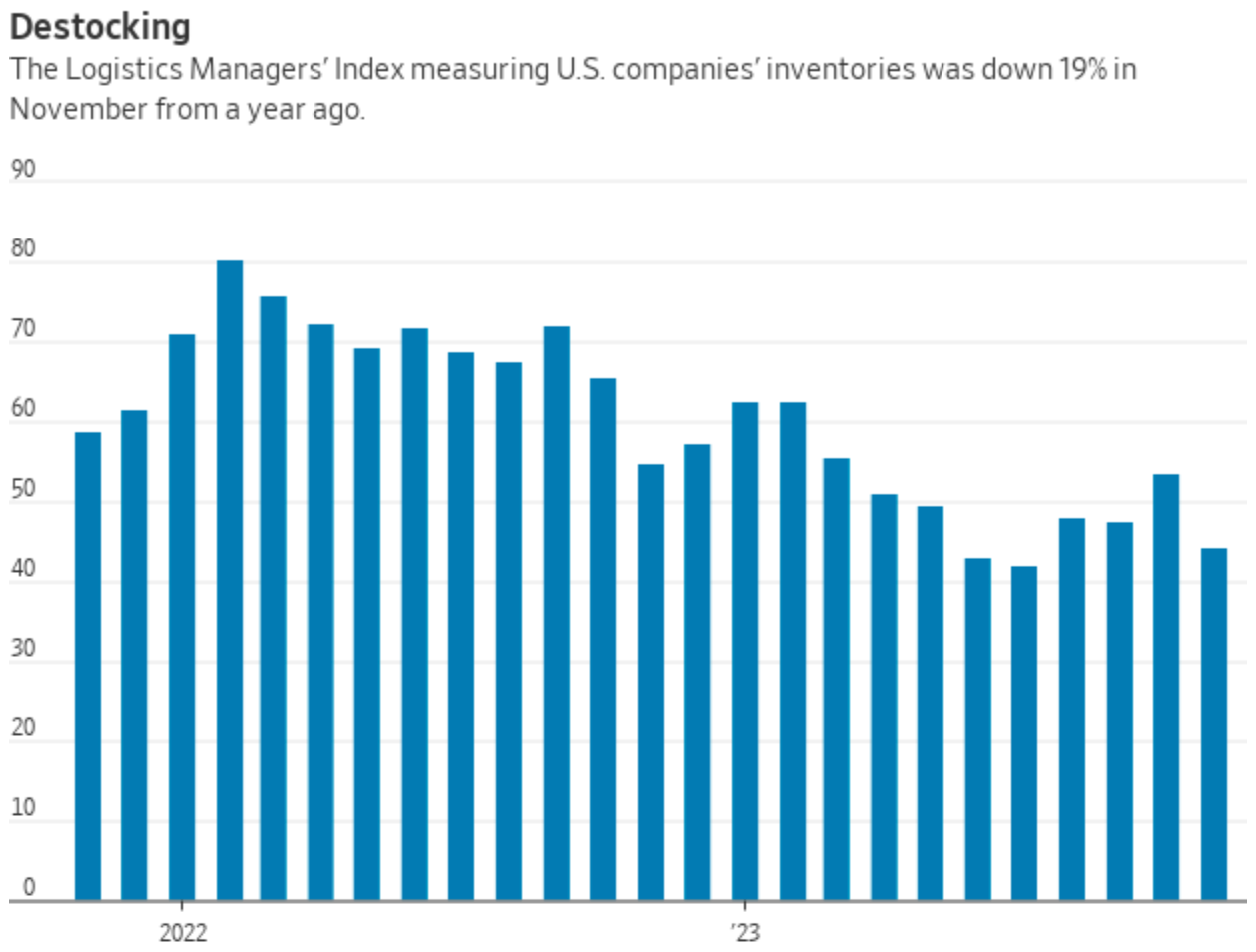

In relative terms, warehousing probably fared the best in a difficult market characterized by destocking of excess inventories through 2023. As shown below, overall inventories are down nearly 20% YoY as companies worked through the COVID-era bullwhip effect. We’d note that through our broader portfolio and network, we heard of several mid-market brands deferring their renewal decisions with their existing 3PL over uncertainty of what to expect in 2024. It is unclear how widespread this was but could provide some support to 2024 warehouse demand.

Source: Logistics Managers’ Index, WSJ

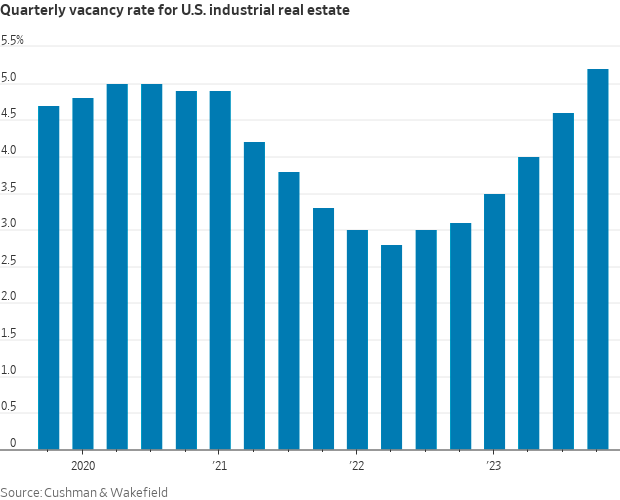

As inventories are drawn down, the demand for warehouses has declined through 2023 with vacancies ticking up as a lagging indicator. It’s worth noting that overall vacancy rates of 5% remain well below the 15-year average of 6.4% which suggests this could be a short-term correction. The weakness in warehousing and fulfillment as it pertains to consumer spending is best demonstrated in the sobering holiday season hiring by the major parcel carriers. For the first time in years, hiring across the major parcel providers was flat or down. Amazon was the only notable company who hired more seasonal fulfillment workers in 2023 vs 2022.

Source: Cushman & Wakefield, WSJ

According to Cushman & Wakefield, new leases for about 588M ft2 of warehouse space were signed during 2023 which was down about 25% on the previous year. However, the sector continues to have long term support with the overall cost of industrial space rising 10% YoY in the final quarter of 2023. We’d note that warehousing remains an area of optimism within the overall real estate sector given that increased industrial activity brings with it warehousing and fulfillment demand.

Stepping back, our belief is that warehousing demand has stabilized which means that the observable outputs for the industry in vacancies and pricing shouldn’t materially deteriorate. We’d note that the majority of consumer-centric inventory destocking has occurred through 2023 with most supply chains poised to increase inventory through 2024 per seasonal norms (build up ahead of summer and the holidays). Additionally, an increase in industrial activity across the US will be a tailwind for more traditional warehousing operations that focus on palletized freight.

Last Mile & Parcel

When considering the last mile, we think about parcel and food deliveries.

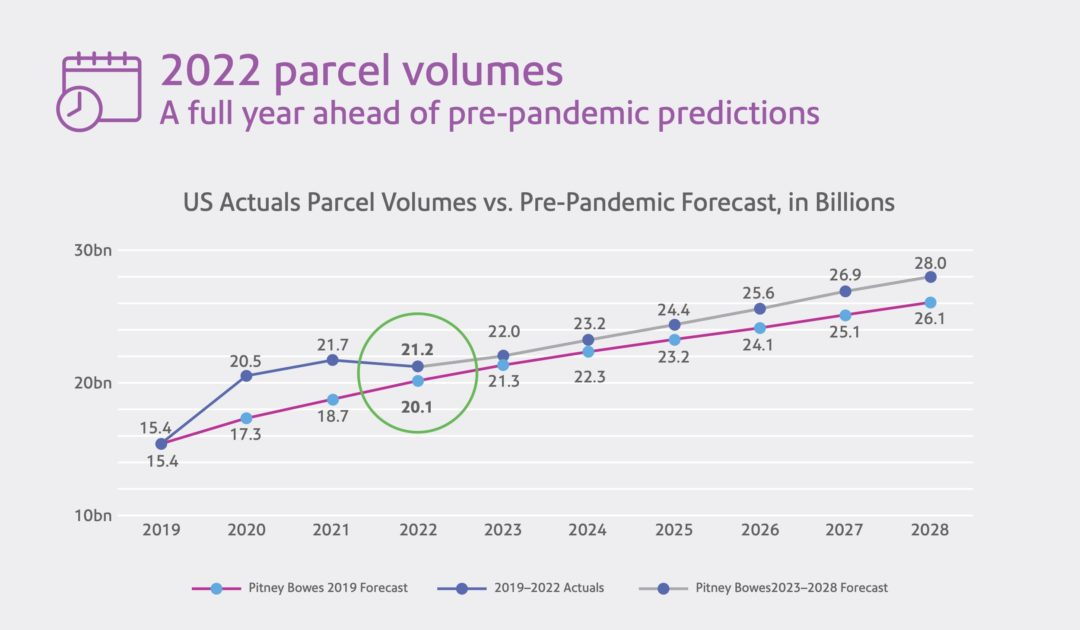

Parcel delivery is closely linked to fulfillment operations and therefore retail purchasing and consumer spending. Referencing the prior statement on muted seasonal hiring in fulfillment amongst the parcel carriers, 2023 appears to have reverted back to the norm. Pitney Bowes will report in late Q1 2024 on total 2023 parcel volumes but coming into 2023, the expectation was for the industry to ship 22B parcels (up from 2022 levels of 21.2B).

Source: Pitney Bowes

On the topic of food delivery, DoorDash’s Q2 2023 delivery volumes of 543M (annualized at 2.2B) are up 27% YoY. Additional data from DoorDash suggest that 80% of US consumers ordered delivery just as much if not more in 2023 vs 2022. Related, the survey noted that delivery or carryout is a weekly habit for US consumers that underpins the above trend. Lastly, ~75% of time food delivery is an urgent or last minute issue so speed is of the essence. All said, 2023 was a good year for food delivery.

Our expectation going into 2024 is that the parcel is heavily reliant on consumers sentiment of feeling “better off” and spending more. For those who have read our previous quarter’s commentary, you know we see a world of high rates for longer periods of time. As such, barring any unforeseen fiscal stimulus, we currently expect the last mile segment to stay flat. We have no reason to believe 2024 is any different from 2023 for food delivery. If anything, our focus on enabling faster deliveries is leaning into the long-term trend — see Manna (Fund II).

The Impact to Dynamo

In thinking about Dynamo’s existing portfolio, we have predominantly two business models: transactional (or full-stack) and SaaS. While both tend to benefit in upcycles and have risks in downcycles, the impact on the former business model is more pronounced.

In assessing transactional business models, we focus on understanding the seasonality and cyclicality of the underlying volumes and rates which can have a material impact on the revenues (and margins) of these businesses. The exposure to the freight economy requires robust pricing and structure of customer contracts, constant awareness of sales rep productivity through a lens of both sales and margin, and allocation of technology spend to areas that meaningfully reduce operating expenses.

When it comes to SaaS businesses, the key consideration is budgetary if selling to an asset-based carrier (whether it is a trucker, ship line, etc.) or intermediary such as a broker or forwarder. These customers face the tailwinds and headwinds of the freight market which means expanding and shrinking budgets. It is rare there will be outright churn but it does require the sales pitch and value proposition to be adjusted. For example, as early as 2022, we advised our SaaS businesses to begin shifting their pitches and customer business reviews to focus on cost savings in an effort to align with the financial priorities of clients. Additionally, in 2023, we leaned on portfolio companies to maximize their Net Dollar Retention by selling into existing customers rather than hunting new ones where any new vendor spend was likely to fall on deaf ears.

When considering new investments, there are a few opinions we hold:

- We feel that LLMs bring an unfair advantage to transactional business models where a company is selling a service. We’re unconvinced that LLMs are best sold as SaaS but instead believe one needs to sell a service that is powered by such capabilities. This better aligns with the expectation of the buyer who just wants an easy button, aligns value and price, and lends itself to stronger margins as a result of higher levels of automation.

The unfortunate timing of the Convoy failure might make people shy of services/transactional businesses at a time where the promise of LLMs to reduce opex has never been greater. We think that the lack of appetite amongst early stage investors paired with the ability to work with strong teams thoughtfully implementing LLMs can unlock exciting investment opportunities for us.

Lastly, we’d acknowledge that 2024 will see large supply chain enterprises along with their consultants touting the development and usage of proprietary LLMs on the back of large data sets. These “end to end” consultant solutions will be expensive to build and maintain. As reality bites, the adoption of “drop in” LLMs to address specific labor-centric tasks will become more obvious over the next 24-36 months and become increasingly common - first being adopted by the mid-market and then expanding into enterprise over time.

- We’re currently holding steady on warehouse automation investments; open to other applications of robotics. We are seeing decision makers pump the breaks on growing spend in robotics as demand is normalized and labor costs become manageable. We’ve also heard from several 3PLs that they’re re-evaluating their appetite for opex (robot as a service) business models in favor of capex in the normalized rate environment. Barring some segments such as pallet loading/unloading, we believe this is a challenging area for the next year or so. Renewed growth in warehouse demand would change this attitude. Instead, we see areas where there is a secular shortage of skilled labor that can also be standardized for automation as ripe for the taking: airport luggage handling and vehicle service/maintenance.

- Sustainability appears to have a level of economic resilience but it needs to provide operational value. Against an uncertain economic backdrop, it’s especially important that one does not embrace a “green premium” or sustainability for sustainability sake. Instead, we’re looking for interesting opportunities where making a decision not only improves the sustainability of an organization but also helps improve its financial profile. Note these opportunities might either be transactional, SaaS, or another business model— it is case-dependent. A few areas we’re excited about include intermodal rail (30% cheaper/90% less CO2), fleet management (improve fuel savings), and sustainable procurement/circularity.