Tariffs, Taxes, & Supply Chain

How governments can influence the future of supply chains using trade policy

Written by Santosh Sankar and Jon Bradford, 2024-07-17

Summary

- Tariffs have re-emerged as a primary geopolitical tool—reshaping supply chains, driving nearshoring, and injecting inflationary friction into global trade.

- From de minimis loopholes to carbon border taxes, policy is colliding with technology—creating complexity, enforcement gaps, and massive administrative burdens across cross-border commerce.

- This volatility creates durable venture opportunities in provenance, AI-driven customs brokerage, and tech-enabled sourcing—where compliance, traceability, and tariff optimization become mission-critical infrastructure rather than back-office overhead.

We’ve had a front-row seat for the last decade as populist ideologies have taken hold both in the US and overseas. With it comes a fervent nationalism and protectionist policies that promise more jobs, stronger local economies, and a more secure society. Tariffs have been a key tool for policymakers looking to reshape and rebuff supply chains since America won its independence.

Tariffs emerged in the United States with the passage of The Tariff Act of 1789, the first significant piece of legislation passed by the newly formed federal government. This act imposed a tariff of about 5% on nearly all imports, with a few exceptions, and was primarily designed to generate revenue to pay for the federal government's expenses and the national debt accrued during the Revolutionary War.

The Tariff Act of 1789 was signed into law by President George Washington and was heavily influenced by Alexander Hamilton, the first Secretary of the Treasury. It is amazing to understand that even at this stage, Hamilton advocated for tariffs not only as a means of raising revenue but also as a way to protect and promote the nascent American manufacturing sector from foreign competition - which has an all too familiar ring to it.

In the interim, there have been multiple attempts to use tariffs to protect local industries, including the infamous Smoot-Hawley Tariff Act of 1930, which raised US tariffs on over 20,000 imported goods to record levels.

It aimed to protect American farmers from foreign agricultural imports, shield US businesses from international competition, and boost domestic production and employment. Its ultimate effect was to trigger retaliatory tariffs from other countries which led to a significant decline in global trade and exacerbated the economic downturn of the Great Depression.

The overall effect was that US imports decreased from $4.4B in 1929 to $1.3B in 1932, its exports fell from $5.4B in 1929 to $1.6B in 1932 and contributed to a 66% decline in global trade between 1929 and 1934.

The Smoot-Hawley Tariff Act is a cautionary tale in economic history, demonstrating the potential negative consequences of extreme protectionist policies. It highlights how well-intentioned efforts to protect domestic industries can backfire, especially in a globally interconnected economy.

Recent History

The Obama Years

As we have previously outlined in opinion pieces, the Obama administration was probably the most liberal of all the most recent US governments. While it did impose tariffs, their policy approach was to balance protecting American jobs and industries with maintaining open trade policies and relationships with trading partners.

Obama emphasized enforcing existing trade rules rather than broadly increasing tariffs. His administration prioritized challenging other countries' practices that were deemed unfair to American workers and businesses. His administration filed 25 enforcement actions at the World Trade Organization (WTO), including 16 against China, to address unfair trade practices. The US won every single case that had been decided by the end of Obama's term, demonstrating a 100% success rate. However, it was argued that the Obama administration was selective in its enforcement for political purposes.

A key change that the Obama administration made was raising the de minimis threshold. This is the threshold in US customs law that refers to the maximum value of goods that can be imported duty-free. The threshold was originally set in 1938 at $5 for items brought into the US with any mailed items at a price threshold of $25. This threshold was raised to $200 in 1994 and to $800 in 2016 under the Trade Facilitation and Trade Enforcement Act, significantly impacting the volume of low-value shipments and benefiting small businesses and consumers by reducing costs and simplifying customs procedures.

The Trump Presidency

During his presidency, Donald Trump implemented significant changes to US trade policy, particularly through the use of tariffs. His "America First" economic policy aimed to reduce the US trade deficit and protect domestic industries.

In early 2018, Trump began his tariff campaign by imposing duties on solar panels and washing machines, ranging from 30% to 50%. This was quickly followed by more substantial measures in March 2018, when he announced a 25% tariff on steel imports and a 10% tariff on aluminum imports, citing national security concerns.

The most significant and controversial tariffs were directed at China. In July 2018, Trump initiated a series of tariffs on Chinese goods, starting with a 25% tariff on $34B worth of Chinese imports. This escalated rapidly, with additional rounds of tariffs imposed throughout 2018 and 2019. By September 2019, nearly $360B worth of Chinese goods were subject to tariffs ranging from 15% to 25%.

Trump's tariff policy wasn't limited to China. He also imposed tariffs on the European Union, Canada, and Mexico, particularly on steel and aluminum. This led to retaliatory measures from these trading partners, escalating into what many called a "trade war."

The administration justified these actions as necessary to protect American industries, reduce the trade deficit, and counter what they perceived as unfair trade practices, particularly by China. However, these tariffs also led to increased costs for American consumers and businesses, retaliatory measures from other countries, and disruptions in global supply chains.

It’s also worth noting that the Trump administration instituted The United States-Mexico-Canada Agreement (USMCA) to replace the North American Free Trade Agreement (NAFTA) on July 1, 2020 in order to promote more trade between the North American bloc. This agreement will last 16 years with review periods every six years. The major elements include:

- Digitizing trade data flows

- Promoting the US agriculture industry by specifically promoting US dairy, egg, and poultry products in Canada

- Outlining the manufacturing and labor requirements for vehicles to not face tariffs. This requires that at least 75% of a vehicle’s componentry be manufactured in North America while at least 40% of the labor requirements are carried out by staff making at least $16/hour

- Setting standards around labor practices, collective bargaining, as well as environmental protections for air quality and marine litter

Despite the tariffs, the US trade deficit grew by $119B between 2017 and March 2019, reaching $621B, the highest since 2008. The tariffs also contributed to increased inflation and triggered retaliatory measures from trading partners, particularly China, which further impacted US exports and jobs, especially in the agricultural sector. While some specific industries vulnerable to cheap imports may have benefited from the protection offered by the tariffs, the overall economic impact was largely negative, with the tariffs failing to achieve their primary objectives of reducing the trade deficit and significantly boosting US manufacturing employment. It’s worth noting that throughout history, protectionist ideologies tend to drive inflation and stagnant growth as policies fly in the face of the bedrock of capitalism- “the invisible hand” that promotes specialization of skills and trade.

The Biden Administration

President Joe Biden's approach to tariffs has mirrored that of his predecessor, Donald Trump, in several key ways, reflecting a continuation of protectionist trade policies aimed at safeguarding American industries and addressing unfair trade practices, particularly with China.

Biden has largely maintained the tariffs imposed by Trump. This includes the significant tariffs on steel and aluminum, as well as the extensive tariffs on Chinese goods. These tariffs were initially justified under national security grounds and as a response to unfair trade practices.

While maintaining the existing tariffs, Biden has also introduced new tariffs that are more targeted and, in some cases, higher than those imposed by Trump. For instance, in May 2024, Biden announced additional tariffs on $18B worth of Chinese goods, including semiconductors, electric vehicles, solar cells, and critical minerals. These new tariffs range from 25% to 100%, with some tariffs effectively acting as a ban on certain imports, such as Chinese electric vehicles.

While Trump imposed a wide range of tariffs on various goods and trading partners, Biden's approach has been more narrowly tailored but with higher rates on specific products. For example, while Trump’s tariffs on Chinese goods were generally in the 10% to 25% range, Biden has imposed tariffs as high as 50% on semiconductors and solar cells and 100% on electric vehicles.

For reference, tariffs currently generate around $80-100B annually for the US government. This represents approximately 2% of the $4.4T in total federal tax revenue. While it is a substantial sum, it represents a relatively small portion of overall US government revenue and highlights its primary function as a tool for domestic and international trade policy.

The $67B De Minimis Loophole

As mentioned before, de minimis is a customs term referring to a value threshold below which imported goods are exempt from customs duties and, in some cases, taxes. This threshold varies by country and is designed to simplify customs procedures for low-value shipments, reducing administrative burdens and costs for both customs authorities and importers. However, increased efficiencies in the supply chain have created the opportunity for this to be exploited - which highlights how government policy can lag technology change.

In the United States, the de minimis threshold is currently set at $800. This means that goods imported into the US with a value of $800 or less are generally exempt from customs duties and taxes. The US has one of the highest de minimis thresholds globally.

For higher thresholds, like those in the US and Australia ($750), easier cross-border eCommerce is generally facilitated and can lead to lower prices for consumers. Whereas, lower thresholds like those in Canada ($15) and China ($8) protect domestic industries but can increase costs and administrative burdens for international shipments, which is also inherently inflationary. It is worth noting the EU has recently abolished its VAT de minimis threshold. All goods, regardless of value, are now subject to VAT. However, there is still a €150 threshold for customs duties. The UK has also adopted a similar approach to the EU.

The EU approach is interesting., as it increases the complexity and administrative burden in the short term. It is also believed that technology will ultimately reduce friction and allow for a level playing field between domestic and foreign sellers, but may increase complexity for cross-border trade.

The de minimis loophole has significant economic implications and in 2023, it was estimated that this loophole accounted for over 1B packages and $67B in lost tax revenue for the US government. This provision, initially intended to streamline customs processes and reduce administrative burdens, has been increasingly exploited by foreign eCommerce companies, particularly those from China.

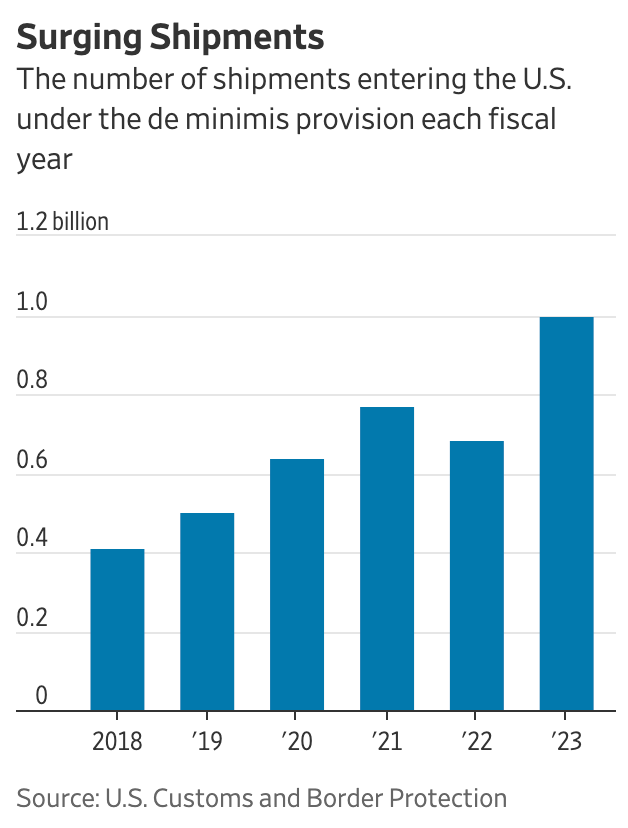

Surging Shipments

The number of shipments entering the US under de minimus each year

Source: US CBP

Companies like Shein and Temu have leveraged the de minimis rule to ship millions of low-cost packages directly to US consumers, bypassing traditional customs duties. This has not only deprived the US of substantial revenue but also created an uneven playing field for domestic businesses, which still face significant import duties. The surge in de minimis shipments has also overwhelmed customs enforcement, complicating efforts to intercept illegal goods and counterfeit products.

The Rise of Temu & Shein

Temu and Shein represent the rise of ultra-fast, ultra-cheap e-commerce platforms that disrupt traditional retail, particularly by leveraging Chinese manufacturing and global direct-to-consumer shipping (as well as the $800 de minimis threshold). While popular among budget-conscious consumers, they also face ongoing questions about sustainability, ethics, and long-term business viability.

Shein and Temu source products directly from Chinese manufacturers (who bear the inventory risk) and deliver directly to the end consumer in the US. This model is what many would say is the most effective execution of “just-in-time” fulfillment. Both merchants have gained popularity through social selling, especially with the rise of platforms like TikTok.

Temu is estimated to have global revenue of at least $6B as of 2023 with over 100 million active users in the US by April 2023, which is notable as the platform didn’t launch until 2022. On the other hand, Shein has been around since 2008 and its global revenue for 2023 was estimated at $32.5B with the US accounting for approximately 28% of its sales - $9B and expected to grow to $14B this year.

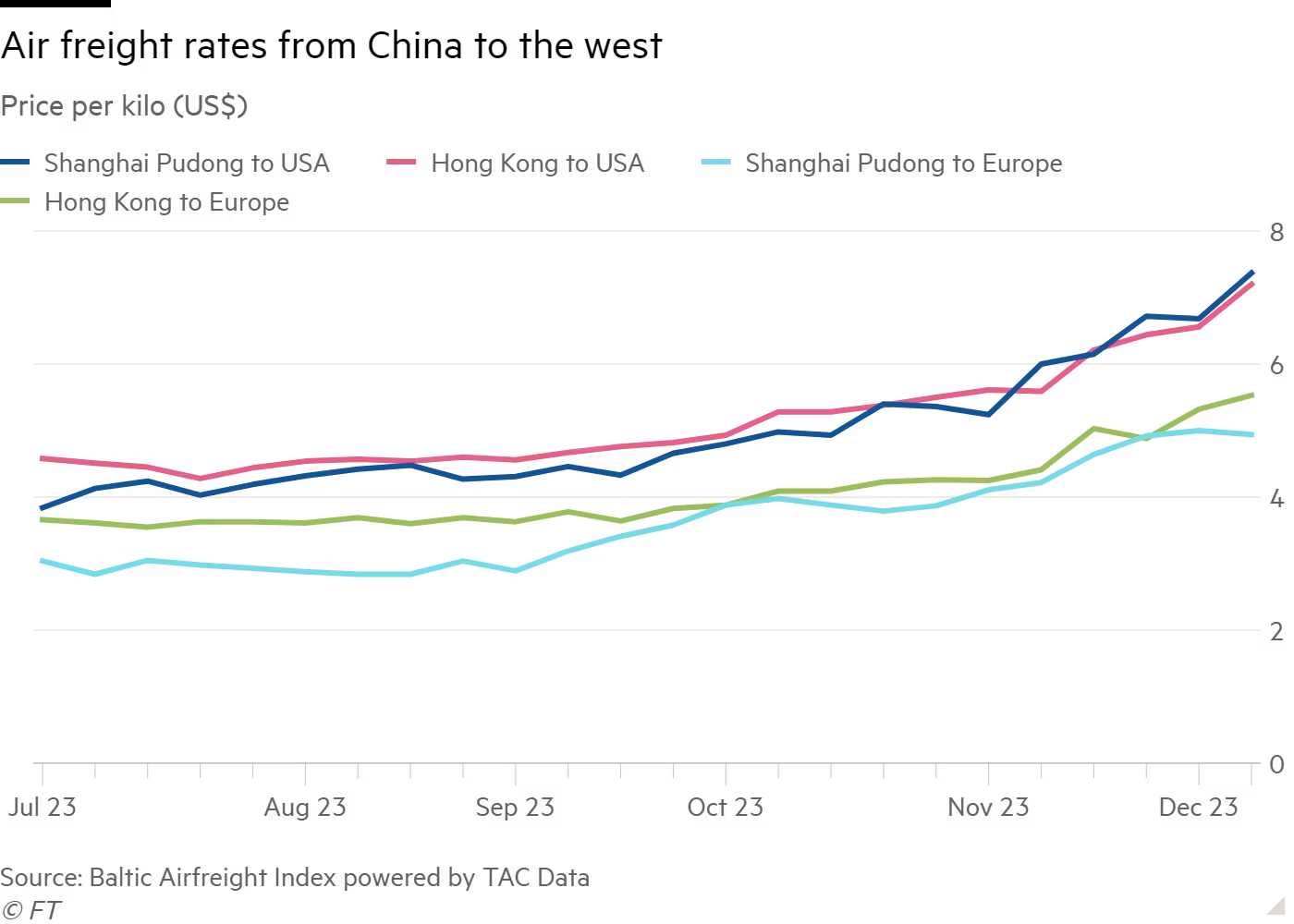

This astonishing growth has led to a boom in the air freight industry, particularly for routes from China to Western markets. The demand for fast delivery of goods from these platforms has led to sustained high air freight rates and e-commerce shipments now account for a significant portion of air freight volume, estimated at 40-50% on most routes and up to 70% in some cases. The average spot rate for air cargo from South China to the US was $5.27 per kilogram in late June 2024, more than double the rates from 2019.

Air Freight Rates from China

In US dollars

Source: FT via Baltic Airfreight Index powered by TAC Data.

The competition for air cargo space is intense, with Temu and Shein consuming over 30% of cargo space on some routes. This is causing concerns about a capacity squeeze during the peak holiday shipping season later in the year which ultimately will also underpin inflation for the US consumer.

While providing a boost to the air freight industry, there are concerns about the potential impact of US-China trade relations on this business model. The US government has intensified efforts to crack down on a controversial customs exemption. The US Customs and Border Protection agency has suspended multiple customs brokers from the Entry Type 86 program, which is designed to expedite the clearance of low-value packages through customs. Note, no tariffs doesn’t necessarily mean no paperwork!

It has been reported that Amazon doesn't plan to miss out on this opportunity and plans to launch a new service aimed at competing directly with Temu and Shein. It has already held private meetings with Chinese merchants to create a platform for inexpensive fashion, home goods, and daily necessities, primarily sourced from Chinese warehouses that will be shipped directly from China to overseas consumers within 9 to 11 days.

EU Carbon Taxes Are a New Tariff

To take us back to Econ 101, a tariff is a charge imposed on imported or exported goods while a tax is a financial charge imposed by a government on individuals, businesses, or transactions. Both generally serve different purposes but can be used interchangeably to influence change in global supply chains.

A new form of tariff is emerging from the European Union based upon the amount of carbon emissions embedded in a product - called a Carbon Border Adjustment Mechanism (“CBAM”) - which for all intents and purposes, is a carbon tax. This carbon tax has been introduced to level the playing field and avoid carbon leakage - which occurs when companies move production offshore to countries with less stringent climate policies and effectively offshore the production of products with higher carbon emissions outside of the EU.

The CBAM mechanism ensures that imported goods are subject to the same carbon tax as goods produced within the EU, thereby leveling the competitive playing field between domestic and foreign manufacturers. The theory is that by imposing a carbon tax on imports, CBAM incentivizes non-EU countries to adopt cleaner industrial practices and align with the EU's climate objectives. Note, as Americans, we would view this as inflationary but for citizens in the EU, this is perceived to be acceptable and the cost of managing climate change - a cultural difference amongst consumers.

The first phase, the transitional period, began on October 1, 2023, and will run through December 31, 2025. During this period, the focus is only on reporting obligations. EU importers of certain carbon-intensive goods - including cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen - will be required to submit quarterly reports detailing the embedded emissions in their imports.

This phase allows businesses to adapt to the new requirements, helps the EU gather data on embedded emissions, and prepares the groundwork for the full implementation of CBAM. While there are no carbon taxes imposed during this period, non-compliance of reporting can result in penalties of €10-€50 per ton of unreported or incorrectly reported emissions.

The second phase will commence on January 1, 2026 when CBAM will begin to have financial implications for importers. They will need to purchase and surrender CBAM certificates corresponding to the carbon emissions embedded in their imports. The price of these certificates will be linked to the weekly average auction price of EU Emissions Trading System (ETS) allowances, ensuring that imported goods face the same carbon costs as those produced within the EU.

To ease the transition, the obligation to purchase CBAM certificates will be gradually phased in. Initially, importers will need to cover only 2.5% of their embedded emissions for 2026, with this percentage increasing annually until it reaches 100% by 2034.

For businesses, particularly those with international supply chains, CBAM presents both challenges and opportunities. While it introduces new administrative burdens, it also encourages a thorough review and potential optimization of supply chains from cost, efficiency, and environmental perspectives. Companies that act quickly to assess and adapt their operations may gain a competitive advantage in this new regulatory landscape.

Opportunities for Venture Investment

The increased use of taxes and tariffs to implement protectionist and sustainability agendas will bring long-term opportunities to the supply chain. Similar to how lawyers and accountants make money regardless of the macro environment, we see elements of customs and trade compliance technology benefiting from a similar analog. A few areas we are excited about:

Provenance of goods that provide clear traceability and compliance with tariff and tax mandates. The single problem with tariffs is being able to validate and prove adherence (or non-adherence) to a set standard and determine whether a tariff applies. This is a highly complex problem that has implications to the nth-tier of a company’s supply chain. Consider validating (with a high degree of confidence) the origin of raw materials, the labor conditions associated with the manufacturing of components, and the transportation journey of the finished product as examples. The ways to solve this run the gamut from novel embedded materials (some startups are experimenting with diamond dust as a marker of provenance), barcodes/IoT for automated data collection through a product’s lifecycle through the supply chain, and machine learning techniques to power analytics that detect product anomalies.

The AI-driven customs brokerage and trade compliance platform. We originally developed the initial elements of this opportunity in 2019 after keynoting a customer summit for Steam Logistics. Combining customs brokerage and trade compliance allow organizations to uphold adherence to regulatory requirements while optimizing trade flows, tariff bills, etc. The combination of using public and private data sets can yield a strong moat for companies thoughtfully executing on a technology-forward strategy. We see the current technology cycle around AI bringing with it a capability to maximize the gross profit per head for services businesses such as customs brokerage, for example:

- Leveraging NLP for tariff classification and tariff optimization

- LLMs handle routine and repetitive tasks to improve the “cost to serve”

- Chatbots for handling inquiries related to the customs code

Sourcing as a Service with the rise of vertical-oriented supply chains. As supply chains shift on the back of nearshoring efforts (in-part aided by things like tariffs), we are seeing an influx of startups and corporates rethinking their sourcing strategy. Sourcing is a highly service-oriented business so equally can benefit from the application of AI into key parts of the workflow. We anticipate seeing a resurgence of sourcing specialists that develop expertise and best practices based on verticals. As a note, there’s a cottage industry of highly cash generative businesses that serve this purpose today. We specifically believe that key industries being nearshored can benefit from such an approach and bring with it lower operating costs, purchasing power, regulatory/compliance capabilities, and defensibility in aggregating complex and fragmented upstream supply chains.

We anticipate opportunities to unfold as there’s more activity with countries and trading blocs establishing and enforcing their trade and tariff strategies. We recognize this serves as a further tailwind to nearshoring and one we will continue to monitor.