A Primer on Workflows Between Manufacturers and Suppliers

Written by Derrek Li, 2024-04-29

Summary

- The recent rewiring of the global supply chain has prompted us to re-examine the workflows around manufacturing — what we consider to be the commencement of every supply chain. Across each of the steps (as outlined below), we identified key pain points that include — as a small preview — manual processes creating inertia/errors, data siloes stemming from differing degrees of systems and tooling, and human tendencies that introduce friction and error along the way

- The focus is on the workflows between suppliers and manufacturers, that has led us to identify five potential areas that we believe are suitable for venture investment

Introduction

We’re currently sitting at the starting line of a large rewiring of the global supply chain driven by a number of macro-level factors including geopolitical instability, secular labor shortages, and heightened concerns around environmental sustainability. In what we dubbed “the rise of regionalization” in 2022, or perhaps better known as “friend-shoring” these days, it’s been a tailwind for developing economies such as Mexico, Vietnam, and other “Alt Asia” peers. The timing of this cataclysmic shift brings with it opportunity to inject new technology as the world rethinks its supply chain.

Along with the Dynamo team, I’ve re-examined the workflows around manufacturing, which we consider to be the start of every supply chain. To be explicit, we don’t view manufacturing as within scope for our core investment thesis, but instead focus on manufacturing enablement. In looking for a space to start, we decided to break down the granular workflows between suppliers and manufacturers to identify and highlight opportunities that could be interesting for venture investment.

🔗For more thoughts on what’s happening around manufacturing, check out our posts on: 📝The Rise Of Innovation In Supply Chain Procurement

Understanding Supplier/Manufacturer Workflows

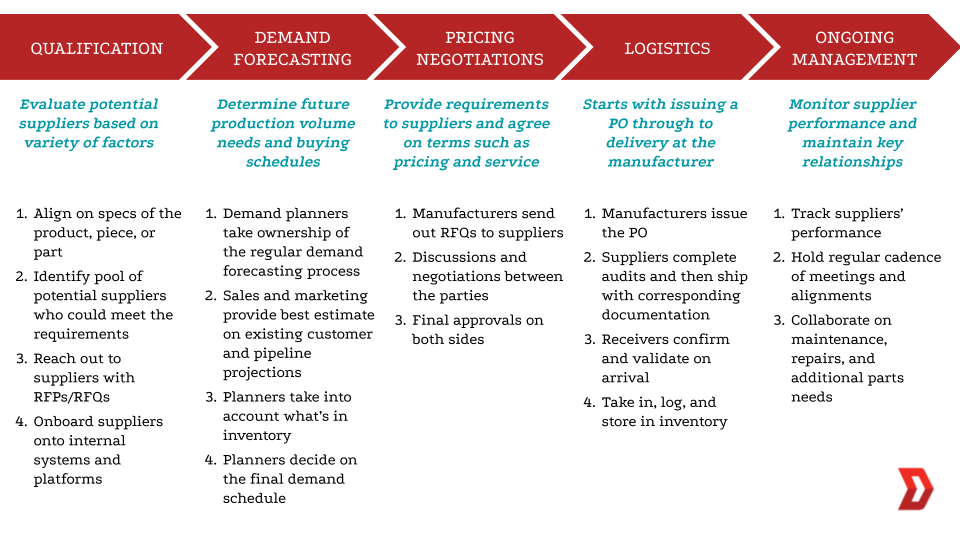

In general, most workflows between a supplier and manufacturer follow the general framework: Qualification > Demand Forecasting > Pricing Negotiations > Logistics > Ongoing Management. While the specifics vary across the many ways you can segment types of manufacturers (i.e. purely assembly to advanced manufacturing using 3D printing to food production), we choose to focus on the similarities that apply to most discrete (as opposed to continuous) manufacturing. Let’s dig in and understand the details of each step and the opportunities inherent to each.

1. Qualification

Manufacturers evaluate potential suppliers based on factors including quality, cost, reliability, and availability.

- Align on the specifications and requirements of the product, piece, or part. Depending on what it’s for, this could be quite simple (e.g. commoditized part) where cost and availability are the highest consideration points. On the other end, it can involve a series of back-and-forth between designers, engineers, and even the manufacturers’ customers for those items that require machining or a complex/engineered solution where quality and reliability matters most

- Identify the pool of potential suppliers who could meet the requirements. Most manufacturers tend to work with known suppliers where they already have a trusted relationship built up. However more and more, manufacturers recognize a need to be more comprehensive in the evaluation of a broader pool. The procurement team tends to own the identification and initial vetting, but the engineering teams may have strong opinions if it’s a particularly critical part

- Reach out to suppliers with RFPs/RFQs. Sometimes a manufacturer will have their exact requirements mapped out already, other times they’ll need additional input from suppliers. This can be an informal process, especially with pre-existing suppliers with deep relationships. It’ll usually be a fairly manual process outside of the more concentrated industries

- Onboard suppliers onto internal systems and platforms. If available, suppliers will connect with manufacturers’ systems such as an ERP or ordering platform via EDI or API. However, this necessarily doesn’t happen as most manufacturers are on custom, homebuilt systems

Pain Points We Observed

- Longstanding relationships with suppliers (sometimes >30 years!) can lead to inertia and resistance to change. These suppliers could often end up having a better understanding of the specifications needed than most of the teams at the actual manufacturer. Not to mention, there’s a prevailing importance of a supplier understanding a manufacturer’s culture and way of doing business that will give incumbents a leg up

- The discovery of new suppliers tends to be an extremely manual process. While there are platforms that try to aggregate and eliminate the need for Google searches, manufacturers don’t find that there’s the required breadth or depth. Many solutions still end up in back-and-forths over chats, emails, or phone calls. On the suppliers end, they may not be fully incentivized to digitize without additional benefits, especially if there’s a proliferation of supplier search tooling that only creates even more overhead

- Determining the quality of components and a supplier can be quite time-consuming. For example, it could take months for a supplier to ship a prototype overseas before the manufacturer’s engineering team begins testing to determine whether it’s a good fit. This could certainly result in additional discussions and iterations of prototype parts before a final decision. Even if there are incremental cost savings of 3-5% with a new supplier, we’ve heard that it may not be worth the hassle for a manufacturer to switch if there are no issues with the current supplier

2. Demand Forecasting

Manufacturers determine future production volume needs and buying schedules.

- Demand planners take ownership of the regular demand forecasting process. They’ll leverage previous forecasts as the base and aggregate all of the relevant inputs from different parts of the business. There are platforms and tooling available, but even in 2024, most end up working across multiple spreadsheets and emails

- Sales and marketing provide best estimate, often a bottoms-up roll-up based on existing customer and pipeline projections. For smaller manufacturers where a few customers make up the bulk of business, the process will be a simple granular projection for each customer. On the other end of the spectrum, there’ll be several inputs across direct sale teams, distributors/resellers, and aftermarket parts expectations on some sort of regular cadence

- Planners will take into account what’s currently in inventory. There’ll be a constant evaluation of previous demand forecasts and what ended up being used vs what is still sitting in inventory. More sophisticated manufacturers will have certain thresholds and ratios they’ll consistently keep in inventory (like the infamous inventory-to-sales ratio that you saw Santosh talk about during the peak of the pandemic). Others may not worry about carrying too much inventory if they’re holding parts that are low-cost, fairly standard, and easy to store with small footprint

- Planners decide on the final demand schedule. This will be based on all of the inputs, but will often require discretion around the expected accuracy of each source

Pain Points We Observed

- Data siloes make it hard to connect the dots across various sources. While demand planners ultimately own the process end-to-end, the data comes from different teams and departments. They’re often presented with multiple forecasts with various degrees of context and need to make the final decision without the granular understanding of each. It requires a holistic understanding of the entire business to make sure different nuances and strategies that have cross-functional impact are properly accounted for

- Sales and marketing tend to be inherently skewed by human behavior. Depending on the sales rep, a bottoms-up forecast can be overly optimistic. In other cases, a few large customers may dramatically swing the forecasts. Santosh had dinner about a year ago with a retired CSCO from a large FMCG who attributed the inconsistency of their forecasts to the “last minute promotions to hit revenue targets” from sales and marketing. His solution was largely around communicating more clearly and not “surprising” supply chain colleagues. Any last-minute changes make it extremely difficult for a supplier to react and adapt for their manufacturer

- Lack of the proper expertise to create an accurate forecast. There is legacy baggage in many organizations of a “this is how we’ve always done it” mentality. While proper forecasting methodology isn’t exactly novel, it does require a certain skill set and knowledge that may not have been there when a manufacturer’s forecasting process was first created. For long-standing manufacturers, this might stem from processes that still follow 1980s statistical techniques. For others, it’s because it wasn’t fleshed out in the first place as people who didn’t come from demand planning or forecasting experience get hired into the roles that look after it. Accuracy targets can range from 75-80% up to 90-95% depending on the methodology and the manufacturer’s specific product SKU

3. Pricing Negotiations

Manufacturers provide requirements to suppliers and agree on terms such as pricing, service level, and expectations.

- Manufacturers send out RFQs to suppliers. Manufacturers will determine all of the factors they care about — including price, production time, and quality thresholds — and compare capabilities from the pool of qualified suppliers

- Discussions and negotiations. Most of the time, this still happens over the phone. Suppliers have tried leveraging tools to expedite the process but not all plants, especially the smaller ones, are properly set up tech-wise to properly integrate. Larger ones will have a central office that handles the iterative back-and-forth common to negotiations

- Final approvals. There is generally some sort of chain of approval that’s needed on the manufacturer side, such as a capital review process for large expenses over a certain threshold, as well as approvals on the supplier side with certain discounts or volumes. What this looks like will vary greatly based on manufacturer size and complexity

Pain Points We Observed

- RFQs are still a fairly manual process for both parties involved. Each RFQ process tends to be slightly different as each supplier or manufacturer has a specific way of running the process. Even if someone has one system and dashboard for all of their RFQs, they’ll often end up downloading them separately to do the proper analysis required in spreadsheets. Tracking historical pricing and quotes for comparisons can mean massive spreadsheets filled with unwieldy volume discount tables. It’s led a mid-market Head of Sourcing who oversees just 3 facilities to beg the IT tech team for a software solution to replace the massive spreadsheet currently in use

- Pricing could end up driving order volumes separate from any demand forecast. There are going to be specific situations, especially in longstanding relationships, where a transaction might happen that’s off-schedule to the demand forecast. In one example given, a paperboard packaging manufacturer could take advantage if its supplier receives a last-minute PO cancellation from a different manufacturer. As long as there’s warehouse space to hold it, it’ll make sense to buy the commodity item at a discount. Other times, a manufacturer’s production demand might be trending lower, but it’ll still order more than needed to meet or maintain a volume discount threshold for the future. In either scenario, while it makes sense financially, it could create issues downstream if not properly accounted for in the system

- There are disincentives for both the supplier and manufacturer in going 100% digital. For suppliers, there’s a potential concern that listing prices directly on a platform makes it too easy for manufacturers to shop and compare all options. It can turn hard-earned trust and relationship-building into a race to the bottom in terms of pricing. That’ll always be a lingering concern when trying to balance the benefits of greater discoverability. On the manufacturer side, it’s not uncommon to hear individual engineers say that they tend to avoid processes that slow them down. If possible, they will try to get around any chain of approvals, such as by putting a purchase on a card and expensing it rather than go through the RFQ process. While it’ll speed up that specific task, it can create gaps in the holistic procurement view

4. Logistics

Starts with issuing a PO through to delivery at the manufacturers’ facilities; the post order management.

- Manufacturers issue the PO. The supplier then acknowledges and verifies accuracy, including quantity, quality, specs, delivery date, location, and payment terms before issuing the invoice

- Suppliers complete audits and then ship with corresponding documentation. Often, the supplier will ensure a quality check of the goods is complete before shipping it out with the necessary documentation. Documentation includes the invoice, packing list, BOL, and shipment confirmation/instructions

- Receivers confirm and validate on arrival. Often with a three-way match of the PO, invoice, and goods receipt, the shipment is processed and verified for accuracy before payment. The manufacturer, or 3PL provider, may also perform quality checks and documentation verification of the certificates of origin or compliance certificates

- Take in, log, and store in inventory. The shipment is taken in, either stored in a warehouse or moved to the appropriate location. It’s important here that the inventory management system (IMS) or warehouse management system (WMS) are updated to reflect the receipt of goods accurately to ensure proper inventory tracking

Pain Points We Observed

- Visibility is still difficult given the data siloes within the manufacturer and with the various partners. Particularly for SMB and MM businesses, getting the right information to the right stakeholder at the right time remains a distant goal. Most manufacturers have stood up their own in-house tooling and systems as best they can, but most likely lack the right integrations across the entire workflow and their various partners. What’s in place today is often described in the best case as “something that works” instead of offering any truly actionable insights. If there is visibility within certain parts of the flow, it’s most likely to be data of what has happened instead of anything that can be used to be too predictive

- Entire logistics process end-to-end crosses many stakeholders and requires compliance throughout. This becomes an entirely different topic that’s subject to the nuances of international logistics, surface transportation, warehousing/fulfilment, and the last mile. In other words, what we here at Dynamo call the remaining steps of the supply chain that comes after the manufacturer. At a high level, each stage requires the creation of various pieces of documentation that are prone to human error, resulting in emails or phone calls to correct even the most basic items like naming, price, and quantity. While there are checks in place throughout the process, it’s usually manual and results in frequent mistakes where visibility and reliability is crucial

- Some manufacturers continue to lack proper systems or training in the warehouse. Even with larger manufacturers, warehousing and inventory management often presents an issue. While it’s expected a greater share of SMBs do not have a system in place, multiple MM manufacturers we’ve spoken with still do not have barcode scanning systems in their warehouses, instead relying on manual labels. Overall, it is estimated that 70-80% of manufacturers have adopted a WMS solution. Others struggle with getting the full frontline adoption of the tools or processes in place. Not surprisingly, adoption is much higher for the larger, more complex operations. This requires not just the technology, but also the right training, tracking (e.g. gamified leaderboards), and change management for it to be successful

5. Ongoing Management

Manufacturers monitor supplier performance and maintain key relationships.

- Track supplier performance. Monitor supplier KPIs and SLAs such as lead times, quality, and reliablity as agreed upon. For most manufacturers, this process often is maintained in spreadsheets

- Hold regular cadence of meetings and alignments. For certain strategic relationships, manufacturers and suppliers will hold QBRs or site visits to maintain strategic alignment. On the other end of the spectrum, there’ll be relationships that are much more transactional and don’t require regular communication

- Collaborate on maintenance, repairs, and additional parts needs. Depending on the industry, there’ll need to be partnerships and agreements on how much support suppliers will provide for repairs

Pain Points We Observed

- Lack of direct visibility in supplier performance. Tracking the various KPIs a manufacturer deems important can be quite manual and end up in endless spreadsheets, presentations, and dashboards. It becomes difficult to parse out key insights and hold suppliers accountable to SLAs when tracking the KPIs across different systems, processes, and teams. A manufacturer might have a good sense of the performance of a specific supplier because they hold regular site visits and QBRs. Even if there’s bandwidth (on both sides) to hold similar high-touch engagements with other suppliers, it’s hard to make apple-to-apple comparisons as the details and focus areas could vary

- The longstanding relationships make it an unfair comparison vs any potential new supplier. Time and time again, manufacturers of all industries and sizes kept coming back to the fact that “we prefer sticking with who we know.” Even if there are incremental savings on costs or lead times, it’s often viewed as the juice simply not being worth the squeeze. There’s an element of not wanting to risk an unforeseen issue with an unproven supplier as the current supplier often delivers reliably. This could create vulnerabilities in the ongoing management and evaluation of the supplier base. Over time, new suppliers with a small wedge in could gain more trust and volume but will need to have the previously mentioned tracking and KPI to quantitatively prove its advantages

- Repairs and maintenance could easily be an afterthought, but has lasting impact on the end customer. While not relevant for all industries, for manufacturers who make large, complex machinery, ongoing performance is a crucial promise made to the end customer. It requires a well-coordinated effort between supplier, manufacturer, and sometimes distributor to keep each other informed of the latest trends and data points so that a spare part or repair instructions is always readily available at the right time and place to keep downtime to a minimum. The supplier might be the party with the most relevant information, but it’s ultimately on the manufacturer to make sure its customers are satisfied

Potential Areas for Venture Investment

As is common when we write about our research, we take a step back and ask, “so what does this mean for Dynamo?” At present, the below are a few areas we’re excited about:

- Purpose-built ERPs for small and mid-sized businesses. It’s hard to imagine a startup coming in and completely displacing an entrenched system of record or engagement (e.g. ERP, WMS, IMS). On the other hand, it’s also common to hear statements such as “no one likes their ERP”. One of the main reasons is the rigidness of these systems — operators are forced to adjust their workflows and processes to fit the ERP. We see room for disruption from new entrants can draw for several areas of strength: 1/ building a simpler solution for the mid market with low-code or no-code implementation capabilities; 2/ leverage GenAI and LLMs to reduce implementation timelines but also make customizations more economically viable (don’t hemorrhage costs with excess man hours) — more on this below; 3/ vertical or use case-specific ERPs that can capture the complexities of a given industry

- LLM-driven approach to demand forecasting. This was the most common pain point that came up again and again across all types of manufacturers. It takes up a lot of time across stakeholders and has costly downstream impact to international logistics, surface transportation, warehousing/fulfillment, and ultimately the customer experience. It’s resulted in a crowded market of solutions but none that seems to truly solve the core of the problem. The statistics require an “adjustment based on context” which can create further deviations/errors. It also requires significant change management to uproot the current process. Given the amount of data wrangling across various systems and context that might be hidden within a sales rep’s emails, a LLM-based solution breaking down siloes could be a low effort way for manufacturers to improve their accuracy. All said, the challenging part of creating ROI in such an environment is the error introduced by the buy/user himself

- Managing manual RFQs and contract negotiation. There are still incredibly manual processes that result in taking action with imperfect data often via manual means — emails, filling out spreadsheets, essays in a document, etc. Both suppliers and manufacturers face too many repetitive steps each time a RFQ comes up as there tends to be small differences with each supplier, manufacturer, or even product. During negotiation, too much time is spent on arduous back-and-forths on contracts with minimal ROI. Instead, a LLM-supported approach can allow the appropriate resources be focused on the most high leverage and strategic negotiations. Both sides should be incentivized to improve the procurement and negotiation process with standardized modules. There are plenty of startups tackling the space, so it’ll require a novel approach or specific industry focus to stand out

- Adherence to SLAs. Across all of the various workflows between suppliers and manufacturers, there are many processes (e.g. product quality, shipment, billing) that have strict metrics and KPIs. While no one wants to break SLAs, it often requires coordination across several stakeholders and leaves room for human error. We believe there’s opportunity fora third-party service that helps hold parties accountable to SLAs by identifying possible breaches, triggering warnings, and administering penalties as needed

- GenAI and LLMs as integration layers. Supply chains are amalgamations of siloed systems that cannot be easily ripped and replaced. As a GE leader mentioned to the Dynamo team several years ago, “a botched software migration has GDP-level implications” which raises the bar for implementation of modern/new technologies. We see novel applications of GenAI and LLMs to write integrations or middleware solutions to help facilitate the adoption of modern tools or capabilities without the need to replace core systems. There’ll need to be a workaround of the current hallucinations that limit fully autonomy, balancing it with some form of human-in-the-loop until properly addresed

⭐ Bonus: QA as a gateway to supplier discovery. For most manufacturers, finding new suppliers is often a burden than opportunity given the details above. However, manufacturers are increasingly recognizing the need to diversify trading partners to improve resilience in an environment where supply chain disruptions are the norm. Stepping back, what better way to find a new supplier partner than reviewing data on the quality of their output? After all, this is what supplier vetting is focused on — “can they deliver the right quality part, on time, at cost, in the right quantity?” We think this opportunity is non-obvious and leverages a lot of the data gathered (poorly) inside the supply chain. Shoutout to Dynamo portfolio company Factored Quality on this front!

These are just five (+1) areas that we find interesting for potential venture-backed startups along this workflow, but that’s not to say there aren’t other compelling ideas for founders to consider. If you’re building in this space, or supply chain more broadly, please reach out. I’d love to learn more — you can reach me at [email protected].

Shoutouts. A BIG thank you to the executives, operators, and founders who provided valuable insights and details as part of this research: Andrew Crown, Brandon Acosta, Dirk Meuzelaar, Emmett LeFevour, Eric Bauer, James Carnrite, Jon Miller, Matthew Williams, Mehul Shah, Paul Noble, Pete Bastien, Rose Chen, Tomas Klausing, and Tony Heldreth.

Check out one of our other posts.